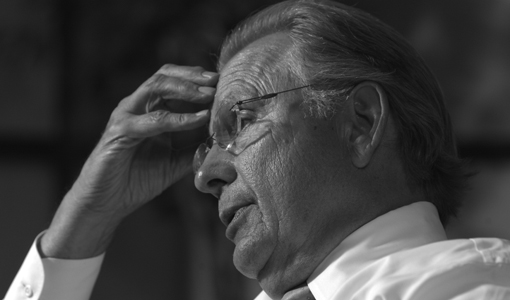

Larry LeJeune laughs when he recalls his father’s words some 50 years ago.

Just a teenager, the younger LeJeune was making $75 a week as a shipping clerk in his dad’s steel fabrication business, had enrolled in college and wanted to get married.

“Dad said, ‘You’re crazy. You can’t support a wife and go to school – or even support a wife, period.’ I was going to prove to him that I could.”

And prove, he did.

It took awhile “and it wasn’t easy,” but LeJeune made good on his promise. He quit school, got married and after a decade bought the family business. Twenty-two years later, he sold the business and bought others, and he is selling luxury import cars to this day.

“I’ve done OK, I guess,” he said. “And I can support my wife!”

LeJeune laughs again at the thought. He believes he has succeeded because he worked hard, took advantage of opportunities, surrounded himself with good people and never forgot his humble beginnings – or those of his parents.

His dad left home at 14, worked as a common laborer in the Chicago area and got to jobs by hopping freight trains. He took the wrong train one day, meaning to head for Indianapolis but ending up in Minneapolis, where he met a waitress at the Curtis Hotel. They married and had five children, with Larry the oldest.

During World War II, the elder LeJeune worked in a New Brighton arms plant for Reuben Anderson, the father of Lee Anderson, another St. Thomas trustee. LeJeune decided to use a bonus from one project to start a steel fabrication business.

“Dad got started in our garage in Robbinsdale, making playground equipment,” LeJeune said. “He was his only employee, and he worked with his hands. One thing led to another and he expanded the business,” which furnished steel beams and columns for houses and commercial projects.

After graduating from DeLaSalle High School in Minneapolis, the younger LeJeune went to the University of Minnesota for a year and St. Thomas for a semester before taking up his father’s “crazy” challenge. Ten years later, in 1967, he and one of his brothers bought the family business.

“I was in charge of sales – $900,000 a year when we took over – and Tom ran the shop,” LeJeune said. “We started going after schools and churches and were successful. We were the upstarts, and we took away business from the more established companies.”

By the time LeJeune bought out his brother in 1977, annual sales at LeJeune Steel had increased to $7.5 million. Business was up and down in the early 1980s, and at one point LeJeune had to call his employees together and make pay cuts ranging from 5 percent to 25 percent (himself).

“I told them, ‘Things are tough. We’re losing money, but we’ll survive. When we make it, I’ll pay you back.’ We made it, and I paid them back.”

Twelve years later, with 200 employees and sales at $40 million, LeJeune found himself still loving the business but sensing “it was time to get out.” He sold to Lee Anderson, who had taken over and expanded his own father’s business into a conglomerate of construction and manufacturing companies now known as APi Group Inc.

“It was very emotional,” LeJeune said of the sale. “Dad encouraged me to sell. He told me, ‘The business will make an old man out of you.’ When I sold it, he was heartbroken. He had started it, after all. My son was working there, and he was heartbroken, too.”

Anderson found the business – still called LeJeune Steel – attractive because he thought “a plant with sparks flying in every direction would give our group of companies some sizzle. It’s not quite the construction services business that we look for, but it has continued to fill our needs along with two other manufacturing businesses that we own.”

LeJeune’s newfound interest was to buy rural banks. But he never bid high enough, and he jokes that “I always thought the other guys were nuts.” Instead, he purchased Carousel Autos in Golden Valley in 1981 and later purchased Maplewood Imports. The dealerships sell 3,000 cars a year.

“The auto business is simple compared to the steel business, with much less risk,” he said. “In the steel business, if I bid $20 million (for a project) and should have bid $30 million, I lose everything. “If I make a mistake on a used car and lose a couple of thousand dollars, that’s not the end of the world.”

A fellow St. Thomas trustee, John M. Morrison, said LeJeune has succeeded in business over nearly 40 years because “he is a methodical, smart, diligent person. Give him a job and he’ll get it done. You’ve heard that old line, ‘Would you buy a used car from this guy?’ Well, I would.”

LeJeune no longer is involved in day-to-day management of the dealerships but has turned his attention toward other interests. He has become an active board member or volunteer in many educational, fine arts and social services organizations. His family foundation supports community programs such as Kids First, which provides private school scholarships to elementary school students from low-income families.

“People just ask and I do it,” he said of his volunteerism. “It’s my way of giving back and sharing my good fortune. I want to be at the table. I’m well-connected around town – I’ve lived here all my life and I’m able to bring other people into an organization.”

He also enjoys spending as much time as possible with his family, which includes his wife, Jean, five children and 13 grandchildren. They all live in the Minneapolisarea and are regular visitors to the LeJeunes’ new home on a horse farm in Medina.

“Larry is one of my true heroes,” said Mike Dougherty, a St. Thomas alumnus and trustee who owns Dougherty Financial Group LLC. “He’s an extremely good businessman. But more important, he is the best husband and father I know. His values are impeccable. He is a role model for everybody.”

LeJeune smiles sheepishly at such praise. He seems uncomfortable with it but appreciates it.

“I like where I am,” he said. “I’ll keep doing what I’m doing right now. It’s a good stage in life.”