University of St. Thomas Finding Forward event featuring Federal Reserve governor explores how much words matter in economics

In many ways the economy is like the weather in Minnesota. It’s hard to predict, can swing wildly, and people love to complain about it but can’t do anything about it.

One of the few exceptions to that last rule, however, is Christopher Waller, a member of the Federal Reserve Board of Governors and one of the people who helps guide monetary policy in the United States.

The actions and statements of the Fed and its leaders can also stoke controversy and fractious political responses. Some accuse the Fed of deliberately trying to game the economy for political reasons; others accuse it of being indifferent to the impact its decisions have on people. Investors sometimes buy and sell based on what Fed members say, influencing the markets.

For all these reasons, Waller chose his words carefully when speaking at the Finding Forward speaker event at the University of St. Thomas in Minneapolis on Feb. 22. Together, along with the panelists who analyzed his remarks following his address, he helped highlight how important transparency and trust are when words and perceptions carry so much weight.

Bottom line: a resilient economy allows a measured Fed response

The headlines from Waller’s speech appeared on news websites within hours: That a generally strong economy means there’s “no rush” to cut interest rates in March; that rumbles in economic data warrant a wait-and-see approach; that the economy appears to be on track to reach the Fed’s two percent inflation goal without a recession; and that he still anticipates rate cuts this year.

“This is a good outcome and (the Fed’s) job is not to stop that, but to rather ensure that the economic fundamentals behind it grow in a manner consistent with us achieving inflation at two percent,” Waller said.

Waller took time to challenge a leading argument of the pro-interest rate cut faction: “Historically, large and rapid rate cuts are highly correlated with recessions,” he said. “This leads to the inference that (high rates) caused the recession. But … if you look back in U.S. history, rate cuts tend to occur after major economic shocks. It's very difficult to untangle.” With no shock apparent – although the Fed will be watchful – there is little risk in waiting to cut rates.

Lessons from the past help guide how Fed talks about the future

When it comes to steering the economy, how the Fed and its members speak is part of the process, said economics professors Tyler Schipper of the University of St. Thomas and Benjamin Pugsley of the University of Notre Dame in a panel following Waller’s remarks.

“One of the great strengths of the Federal Reserve System is that it's built up an incredible amount of credibility,” said Pugsley. People today generally believe the Fed when it says that long-term the economy will be strong, so they invest, spend and plan with that future in mind – which in a circular fashion helps influence inflation and the economy.

Schipper agreed. “The Federal Reserve is haunted by past experiences where they have had high inflationary periods and they started lowering too soon and had to go back on it,” he said, referring to the (Paul) Volcker era of the late 1970s and early 1980s. “That looked like a loss of credibility.”

By contrast, today’s Fed has been clear about its goals, steadfast in pursuing them, and transparent in its decisions, Schipper said. That should help defuse some of the criticisms and conspiracy theories that surround the Fed. “There is a perception that the Federal Reserve is the puppet master behind the curtain,” he said. “They’re trying to be as transparent as possible about what they’re doing and why they’re doing it. If you rewind the clock a few decades this wouldn’t have been typical.”

A unique era that will make history

Everyone agreed that the economic experience of 2020 through today was unlike anything that has gone before. The rapid but temporary job losses, snarled supply chains that are loosening and wholesale shifts in consumer spending are unique, so it’s hard to say what all contributed to the economy’s apparent “soft landing” – while acknowledging that the final chapters of the story are not yet written.

Waller, Schipper and Pugsley all recognized that economists of every persuasion still have a lot to learn, and that new factors will change the economy in as-yet-undetermined ways. All of them also recognized that consumer spending, even in the face of economic uncertainty, played a huge role in stabilizing the economy. “Consumers just kept showing up,” Schipper said.

“These last few years will be studied for decades in every economics class going forward,” Waller said. “We still talk about Paul Volcker from 40 years ago. I want my personal legacy to be I did everything I could for the good of the country. And I think my colleagues are all in the same boat.”

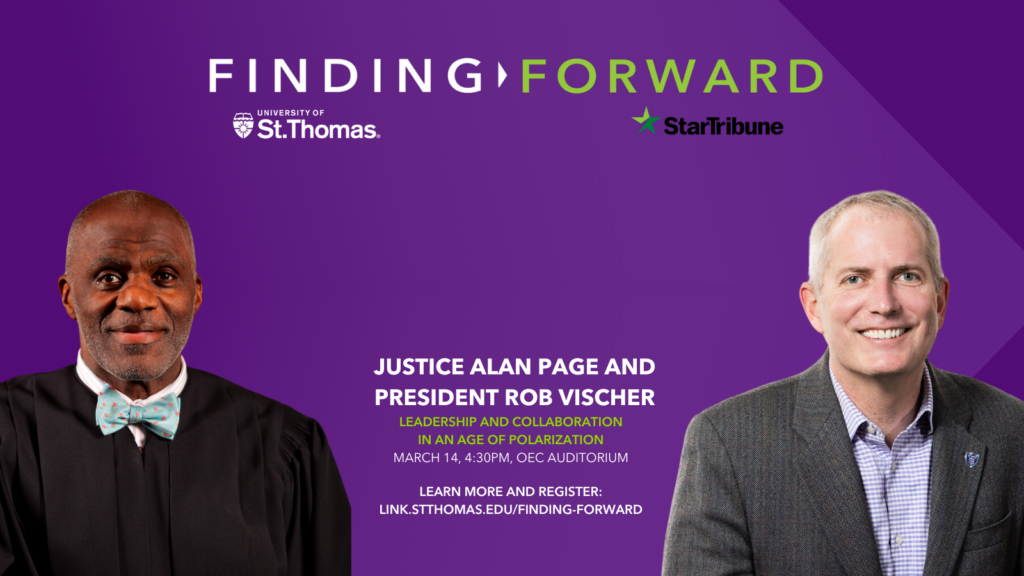

Finding Forward’s next event will be held on March 14

Justice Alan Page joins St. Thomas President Rob Vischer for a conversation about leadership and collaboration in an age of polarization.