Positive signs

With the exception of a historically low supply of homes on the market, an analysis of Twin Cities real estate data for March shows positive signs any way you look at it.

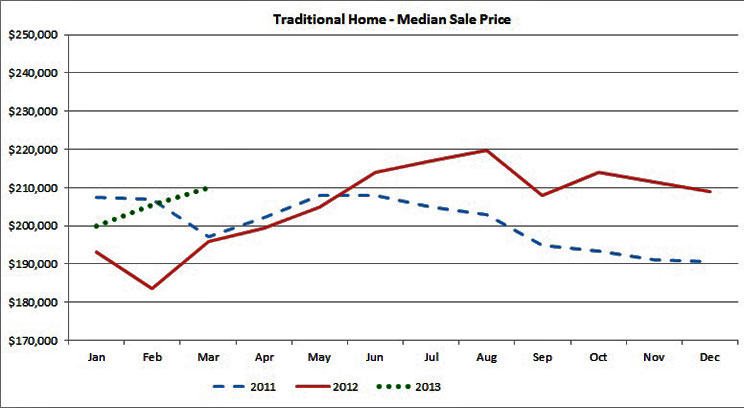

In the Twin Cities, the median sale price of a traditional home (not a foreclosure or short sale) in March was $209,900, the highest seen since last summer. It’s up 2.4 percent over the February median price of $205,000 and up 6.04 percent over the March 2012 median price of $197,950.

That’s according to the Residential Real Estate Price Report Index, a monthly analysis of the 13-county metro area prepared by the Shenehon Center for Real Estate at St. Thomas’ Opus College of Business.

Each month the center tracks nine housing-market data elements, including the median price for three types of sales: nondistressed (traditional-type sales), foreclosures, and short sales (when a home is sold for less than the outstanding mortgage balance).

In his analysis for March, Herb Tousley, director of real estate programs at the university, examined the impact of better economic conditions on different facets of the housing market.

“Employment plays a major role in household formation,” he explained. “As the number of people who are employed increases, more people will be moving into places of their own.”

Minnesota’s unemployment rate of 5.5 percent is well below the national average, and the state added 50,800 jobs in the last six months.

“These positive employment indicators will increase the rate of household formation, requiring additional housing units. Since the inventory of existing homes for sale is expected to remain at historically low levels in the near-term future, look for continued growth in the number of new homes built in 2013.”

And that, he said, has turned up a new wrinkle: where to build the houses.

“The increase in the construction of new homes is beginning to create a shortage of finished lots,” Tousley said. “The number of vacant, developed lots in Minneapolis and St. Paul has been decreasing over the last several years.”

At the end of the first quarter of 2012 there were 27,093 vacant, developed lots in the Twin Cities metro area, or a 101-month supply. By the end of the first quarter of 2013, the number had decreased to 24,559, or a 58-month supply.

“As the shortage continues, home builders are finding they have to pay premium prices for desirable lots,” he said.

From Jan. 1 to April 11 this year, 1,177 building permits were issued for single-family home construction in the metro area. That is a 54 percent increase compared to the same period a year ago, when 763 permits were issued; moreover, the sale of new homes was up 12.2 percent in March compared to the same month a year ago.

How scarce are used homes in the Twin Cities? In March 2013 there were 12,941 homes for sale; that compares to 18,291 in March 2012 and 23,467 in March 2011. Put another way, In March 2013 there were 3.47 homes for sale for every closed sale; in March 2012 the ratio was 4.85; in March 2011 the ratio was 6.93; and back in March 2008 it was 11.1.

Tousely said that since the beginning of 2012, the inventory of homes for sale has been consistently running 25 percent to 30 percent below the previous year’s level. As he has explained in earlier reports, as median sale prices increase and homeowners’ equity positions improve, eventually more homes should be listed for sale.

Another positive note in the March report is the growth in nondistressed or “traditional” sales not affected by mortgage foreclosures or short sales. In March 2012 there were 1,885 traditional sales, or 51.8 percent of all sales in the metro area. In March 2013, there were 2,318 traditional sales, which was 62.1 percent of the total. That’s an increase of nearly 20 percent.

“As we move into the spring and summer of this year we should see a stronger housing market that is dominated by traditional sales,” Tousley said. “Look for the percentage of distressed sales to continue to moderate as we continue into the summer selling season. There will be fewer foreclosures and short sales on the market as the economy continues to improve.

“Increasing median sale prices means that fewer home owners will be ‘under water’ and an improving employment situation will lead to fewer borrowers becoming seriously delinquent on their mortgages.”

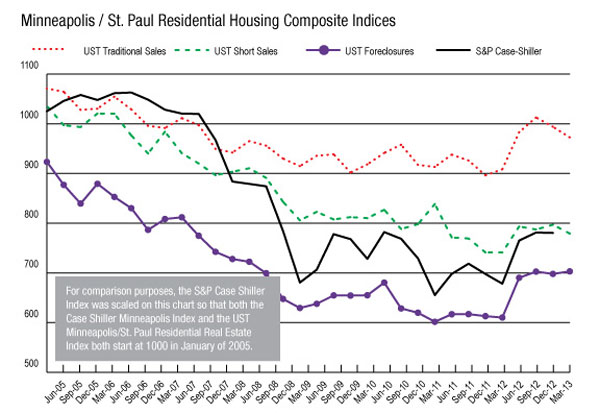

More details about the market, including the composite indexes for traditional, foreclosure and short sales, can be found on the Shenehon Center’s website.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley at hwtousley1@stthomas.edu.