Leaders in the field of Minnesota commercial real estate expect to see a continuation of the favorable market conditions for commercial real estate that we have been experiencing for the past two to three years.

That is the theme of the 11th Minnesota Commercial Real Estate Survey that was conducted in May 2016. The semiannual poll of 50 Minnesota commercial real estate leaders from the fields of development, finance and investment is conducted by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

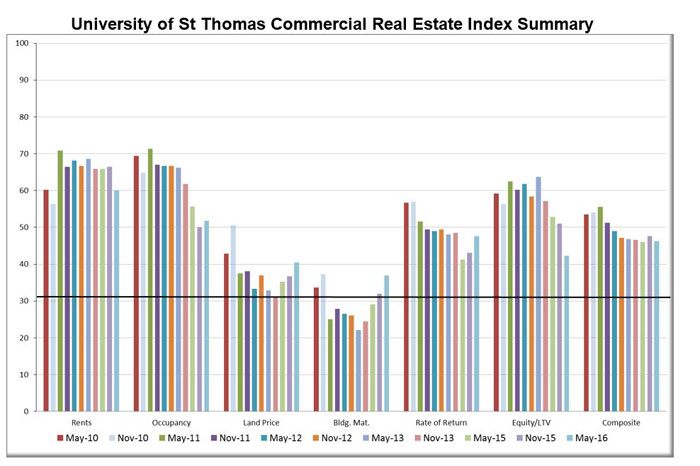

In all 11 surveys the same group of 50 industry leaders have been polled on their expectations for future commercial real estate activity in six categories: rents, occupancy levels, land prices, cost of building materials, rate of return and equity requirements. Their responses are used to create index scores that can be compared over time. Scores higher than 50 represent a more optimistic view of the market over the next two years; scores less than 50 represent a more pessimistic view.

“Overall, the survey continues to indicate a slightly less than neutral expectation looking ahead two years to spring 2018 for commercial real estate,” said Herb Tousley, director of real estate programs at the university. “Our panelists see continuing activity at or near present levels in most categories of commercial real estate.”

The composite score for the May 2016 survey stands at 46 and is the sixth-consecutive survey where the composite index has been in the 46 to 48 range.

Tousley said that May’s survey found less variation in the responses from panelists, reflecting the panel’s increased certainty in members’ views.

Although the overall index score is similar to the scores of recent surveys, there were some changes within the six categories. Here’s a look at the panel’s responses for each of the questions.

Rent expectations

The index score for rental rates declined from a more-optimistic 66 to a less-optimistic 60. This indicates an expectation of a moderation of rent growth over the next two years.

Land price expectations

The panel’s outlook for land prices was less pessimistic for the third-consecutive survey, moving from 37 last fall to 40 this spring. While still in pessimistic territory, the more positive score indicates an expectation that land prices will moderate their rate of increase during the next two years.

Building material price expectations

The building-material index moved from a pessimistic 32 to a somewhat-less-pessimistic 37. That’s the fourth-consecutive improvement and reflects the panelists’ belief that building material price increases are expected to moderate.

Return on investment expectations

The index for investors’ return is 48, a slight increase for the third-consecutive survey.

“The consensus of the panel indicates that investors’ expected returns will not change significantly in the next two years,” Tousley said.

Lending expectations

The index score in this category decreased significantly, falling from 51 last December to 42 in May. “This indicates the panel’s strong belief that credit will be available for good projects but lenders will increase their equity requirements in the coming two years,” Tousley said.

More information

Additional details can be found on the Shenehon Center’s website.