Researchers say the metro area is one of the most-affordable housing markets in the nation.

All signs are pointing in the right direction for a good year in the Twin Cities housing market in 2014, according to the Residential Real Estate Price Report Index, a monthly analysis of the 13-county metro area prepared by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

Each month the Shenehon Center tracks nine housing-market data elements, including the median price for three types of sales: nondistressed or traditional-type sales, foreclosures, and short sales (when a home is sold for less than the outstanding mortgage balance).

Herb Tousley, director of real estate programs at the university, said that in the Twin Cities:

- job creation is up,

- household formation is up,

- interest rates are expected to remain relatively low,

- the percentage of distressed sales (foreclosures and short sales) continues to decline,

- the existing inventory of homes for sale will improve,

- and home prices will continue their recovery.

“The bottom line is that all of these things indicate that 2014 will be a definite step toward the full recovery of the Twin Cities housing market,” he said.

This month’s housing report also noted that home ownership is and will continue to be very affordable in the state and that the Minneapolis and St. Paul area is one of the most-affordable housing markets in the nation.

According to the real estate website Trulia, it is 46 percent cheaper to buy than rent in the Twin Cities, compared to the national average of 35 percent. The owning vs. renting comparison is calculated for an average family that will not move for seven years and makes a 20 percent down payment. It factors in all of the costs for both options at current market conditions.

Tousley said the economic fundamentals that are important to the housing market are these:

Low unemployment: Minnesota’s unemployment rate of 4.8 percent is the lowest since December 2007. The Twin Cities rate of 4.1 percent, meanwhile, is the lowest rate observed in the 50 largest metropolitan areas in the nation.

Job creation: This is improving; from October 2012 to October 2013, slightly more than 50,000 new jobs were created in Minnesota and about 34,000 of those were created in the Twin Cities area.

Household formation: More new jobs and higher employment rates lead to increased household formation, an important driver of the need for more new homes. Household formation increased in 2013 and will accelerate in 2014.

Interest rates: These are expected to remain relatively low in 2014, remaining at about 4.5 percent for a 30-year mortgage. They might move up toward 5 percent during the second half of the year. Also expect to see some improvement in the process of obtaining a mortgage and credit availability.

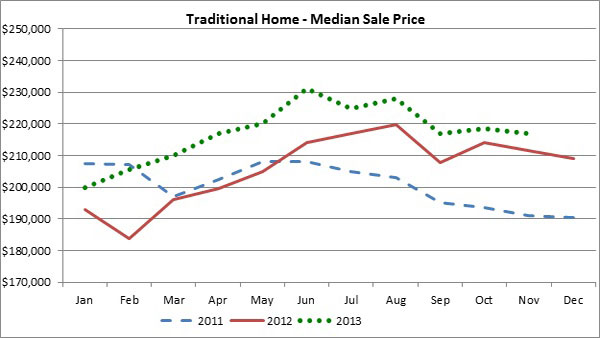

Median sale prices: These will continue to increase in 2014. Prices increased 13 percent in the past year, the second-consecutive year of double-digit increases. A low supply of homes for sale, low interest rates and improving economic conditions will continue to put upward pressure on median home-sale prices. Look for more moderate price increases of 4 percent to 6 percent. This rate of growth is healthy and sustainable as the metro area housing market continues to recover.

Housing bubble question: Will the increases in home prices lead to a housing bubble? The short answer is no. According the Trulia’s “Bubble Watch,” the Minneapolis-St. Paul housing market is 12 percent undervalued relative to underlying fundamentals. This percentage is arrived at by comparing today’s prices with historical prices, rents and incomes.

Specifically for the month of November, the Shenehon Center found that market indicators took an expected seasonal downturn from October, but that indicators for November 2013 were running ahead of November 2012.

One especially bright spot in the data is that the percentage of distressed sales (foreclosures and short sales) stood at 21.9 percent, well below percentages in the mid-30s seen last fall and winter.

The median price of a traditional (nondistressed) metro area home in November was $217,000, down from $218,750 in October but 2.8 percent higher than the $211,075 median price recorded in November 2012. Tousley said this is consistent with earlier predictions that the annual rate of increase in the price of a traditional home will moderate from the double-digit gains seen earlier this year and last, and remain in the 3 percent to 5 percent range for the rest of 2013 and the first quarter of 2014.

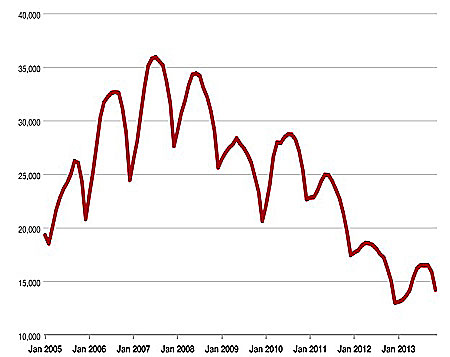

The inventory of metro-area homes for sale remains very low; the 14,165 homes listed in November was 5.5 percent lower than the 14,990 available during the same month a year ago. The Shenehon Center predicts this will improve in the second half of 2014 as rising prices reduce the number of homeowners who are “under water” with their mortgages.

The 5,240 new homes under construction during the third quarter of 2013 is 46 percent ahead of last year’s pace. “Look for new-home construction to make additional major gains in 2014 as conditions will be very favorable for new single-family-home construction,” Tousley said.

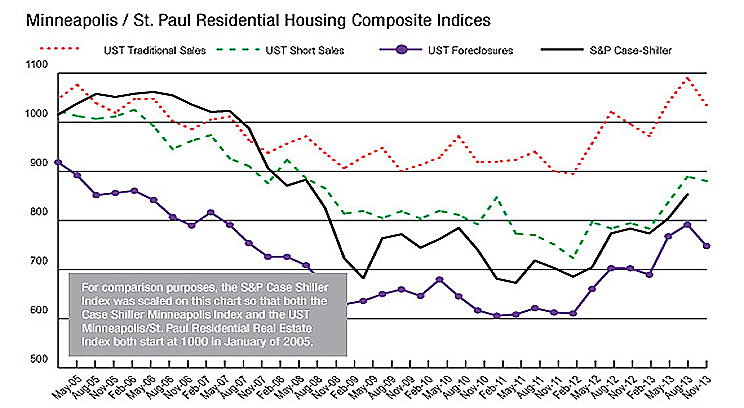

The St. Thomas Indexes

The St. Thomas Traditional Sale Composite Index, the one that tracks nine data elements, stands at 1035 for November. It took a 22-point seasonal downturn from October but is 3.9 percent above November 2012.

Likewise, the November index for short sales is 11 percent higher than a year ago and for foreclosures, the index is 6.9 percent higher.

More information online

The Shenehon Center’s full report for November can be found here.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley at hwtousley1@stthomas.edu.