After a particularly cold and snowy winter, researchers at the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business were expecting to find indications of a robust spring recovery in the 13-county Twin Cities housing market.

“The numbers we analyzed for March were not bad, but not as good as we expected,” said Herb Tousley, director of real estate programs at the university. “We will be closely watching the nine categories of housing data that we track each month to see what direction they take.”

Here is what they found in the March data:

Existing-Home Sales

“As the weather began to warm in March, the housing market in the Twin Cities began to thaw as well,” Tousley said.

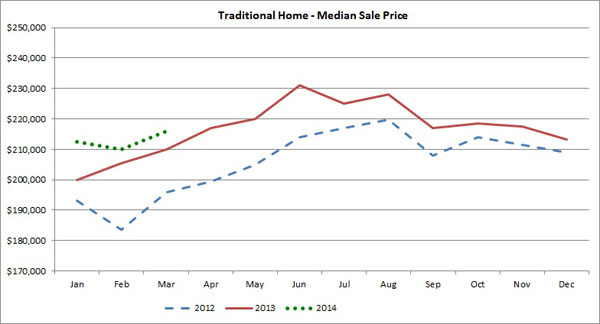

The Shenehon Center tracks the median price for three types of sales: nondistressed or traditional-type sales, foreclosures, and short sales (when a home is sold for less than the outstanding mortgage balance). All three were up in March. For a traditional-sale home, the median price increased from $210,000 in February to $215,900 in March.

“Although this represents a 2.9 percent increase over March 2013, it is less than the 4 percent to 6 percent increase we are expecting in 2014,” Tousley said. “We will be watching year-over-year increases very closely as the spring and summer selling season unfolds.”

Tousley said another statistic that came in lower than expected is that the number of nondistressed homes sold in March 2014 was slightly less than in March 2013. He said it’s not a serious problem in itself, but “is another area that bears continued examination in the coming months.”

The number of homes available to purchase improved slightly in March but remains at a historic-low level with 13,188 properties on the market. “We will keep a close eye on the inventory as the year proceeds because the number of homes for sale will have a direct impact on the percentage of increase in median sale prices during 2014,” Tousley said. “We have been expecting an increase in the number of homes for sale in the 15 percent to 20 percent range as we move into the spring and summer selling seasons due to the healthy increase in sale prices over the past year and generally improved economic conditions in the region.”

The percentage of distressed home sales (foreclosures and short sales) in March was 26.7 percent, an improvement over the levels seen in January and February. “We expect the percentage of distressed sales to fall below 20 percent in the second quarter of 2014,” Tousley said. “It that does not happen, it will be another cause for concern about the continuing sustainability of the housing-market recovery.”

New-Home Construction

According to the Keystone Report, in the first quarter of 2014 the 1,097 single-family home permits issued was up 4.1 percent over the first quarter of 2013. Tousley noted that the extremely cold weather in January and February had an impact on new-home construction, but that the number of permits in March 2014 was up 50 percent over March 2013. “With the warmer weather, construction is snapping back to pre-winter levels.”

“The number of new permits issued in the next two months will merit close attention as they will set the tone for construction activity for the rest of the year,” he said. “The expectation is that the spring construction season will see a flurry of new construction as home builders seek to make up for time lost in January and February. If construction activity does not return to levels that are at least 20 percent to 25 percent higher than last year, it will be a cause for concern about the sustainability of the continued recovery.”

Interest Rates and Affordability

Mortgage rates have declined slightly with a 30-year fixed rate near 4.25 percent. If the economic recovery continues, Tousley expects the rate to increase to around 5 percent by year-end, but if the recovery begins to falter, the rates might not increase that much.

A year ago the 30-year fixed rate was about 3.5 percent and, Tousley said, “there is ongoing concern about higher mortgage rates hurting the recovery, but home buyers are finding ways to compensate.”

Some homeowners, he said, are opting for hybrid and adjustable-rate mortgages that start out at lower rates.

“If interest rates increase moderately in 2014, we believe the rate of recovery in the housing market may slow down, but we don’t believe that it would derail the recovery.”

The Federal Reserve Bank, he said, is going to have to maintain perfect balance between keeping mortgage rates at a low-enough level to maintain the housing-market recovery and a more robust general economic recovery that would result in somewhat higher interest rates.

The St. Thomas Indexes

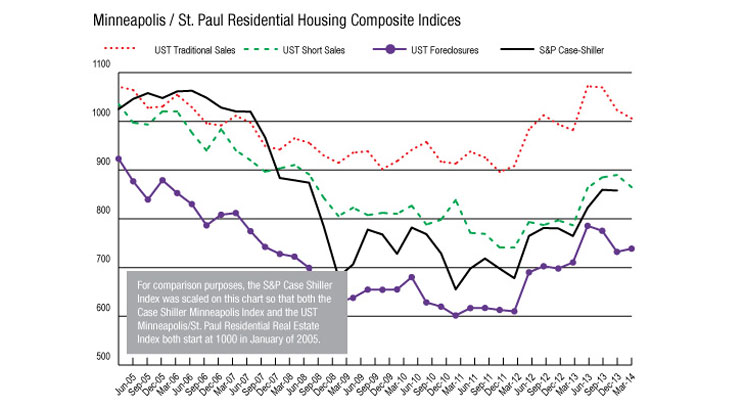

Each month the Shenehon Center tracks nine housing-market data elements for three types of sales: nondistressed or traditional-type sales, foreclosures, and short sales (when a home is sold for less than the outstanding mortgage balance).

The St. Thomas Traditional Sale Composite Market Health Index registered its first increase of the year in March 2014, moving from 995 in February to 1006 in March, a 1.1 percent increase. The index for March 2014 is 2.65 percent higher than for March 2013.

The St. Thomas Short Sale Composite Market Health Index was 865 in March 2014. That’s up 10 points from February 2014 and up 10.3 percent from March 2013.

The St. Thomas Foreclosure Sale Composite Market Health Index was 739 in March 2014. That’s up 2.5 percent over February 2014 and up 4.23 percent over March 2013.

More Information Online

The Shenehon Center’s charts and report for March can be found on its website.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley at hwtousley1@stthomas.edu.