A semiannual poll of Minnesota commercial real estate leaders shows that the mild optimism they held for their industry in 2010 and 2011 has slipped into a mild pessimism.

That is the key finding of the Minnesota Commercial Real Estate Survey, a poll of 50 Minnesota commercial real estate leaders from the fields of development, finance and investment. The survey has been conducted each fall and spring since 2010 by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

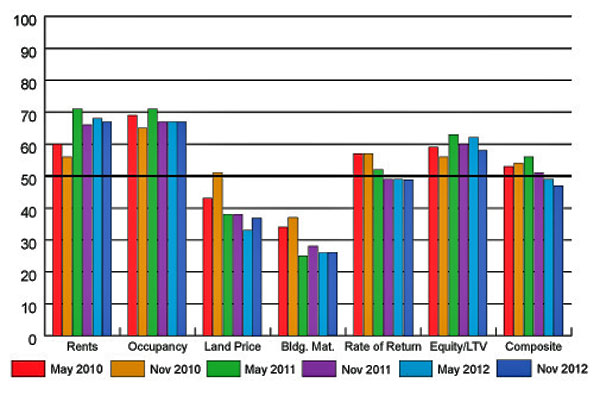

The fall 2012 composite index was below 50 for the second-consecutive survey. An index score higher than 50 represents a more optimistic view of the market over the next two years, while a score lower than 50 indicates a more pessimistic view.

The fall 2012 index was 47, and the spring 2012 index was 49. This continues a downward trend since spring 2011 when the index was 56. In all six surveys the same group of 50 industry leaders were polled on their expectations of near-term, future commercial real estate activity.

“Our surveys conducted in 2010 and early 2011 indicated some mild optimism on the part of the panel with expectations of improving market conditions in 2012 and early 2013,” said Herb Tousley, director of real estate programs at the university.

“Market conditions over the past year have demonstrated some improvement in most areas of commercial real estate, which is consistent with those earlier survey results. The results of the surveys conducted in the spring and fall of 2012 show a change in attitude about expected market conditions in 2014 – turning from slightly optimistic to slightly pessimistic,” he said. “We will know in about 18 months if the survey respondents’ change in enthusiasm was well-founded.”

“Our panel members continue to be confident that rents and occupancy will continue to grow in the next two years, although they are indicating that the rate of growth will be slower than previously expected.

“The expected increase in land prices and building materials will continue to have a negative impact on development activities. They expect that financing terms are going to continue to remain stable and there should be moderately increasing amounts of equity capital available.

“That being said, lenders and investors are going to continue to be very selective in their underwriting criteria and evaluation of potential deals. The bottom line for the fall 2012 survey finds our panel showing increased concern about uncertain economic conditions and their hindering effect on the commercial real estate market. The shift in the composite index from mildly optimistic to slightly pessimistic reflects the panel’s increasing uncertainty about general economic conditions in the next two years,” Tousley said.

The fall 2012 survey was conducted just after the 2012 general election. In addition to the survey’s standard questions on commercial real estate, panel members were was asked if results of the election had influenced their outlook for the commercial real estate market.

Approximately 37 percent of the panelists responded to the election question and a large majority agreed that their outlook had been negatively influenced by the outcome of the elections. None of those responding to the election question were optimistic.

The panelists who stated that their responses were influenced by the election were then asked to rate, on a scale of 1 to 5, if they had become more optimistic or pessimistic. The results are:

- More Pessimistic, 5.6 percent;

- Pessimistic, 61.1 percent;

- Neutral, 33.3 percent;

- Optimistic, 0.0 percent;

- More optimistic, 0.0 percent.

The survey is conducted and analyzed by Tousley and Dr. Thomas Hamilton, associate professor of real estate at St. Thomas. Additional details, including the poll’s outlook on market conditions, rental rates, occupancy levels, land prices, cost of building materials, equity requirements and return on investment can be found on the Shenehon Center’s website.