October’s uptick in the median price of a Twin Cities traditional-sale home (not a short sale or foreclosure) didn’t last long. The numbers are now in for November, and they show that traditional-sale prices have resumed a downward trend that began in July.

According to an analysis released today by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business, the median price of a traditional-sale home in the 13-county Twin Cities market decreased from $189,600 in October to $185,500 in November.

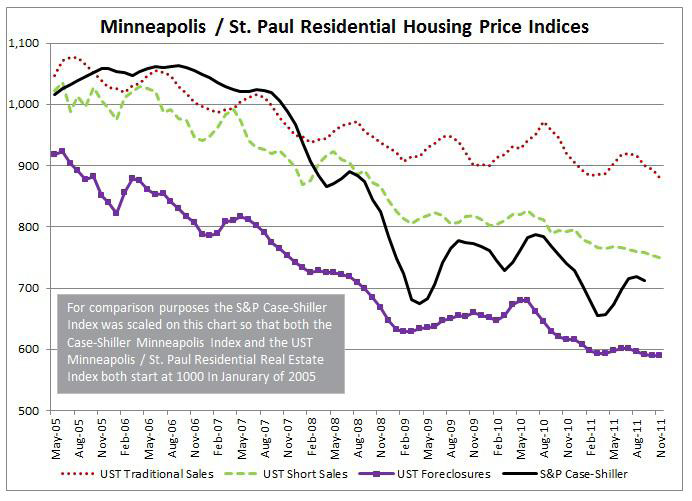

The St. Thomas Residential Real Estate Price Report Index, now in its sixth month, tracks the median prices for traditional home sales, short sales (homes sold for a price less than the outstanding mortgage balance), and sales where the home’s mortgage has been foreclosed.

In all three categories, the median prices have fallen below the lowest levels recorded in 2009.

Altogether, the Residential Real Estate Price Report Index tracks a total of nine data elements to measure the health of the Twin Cities market. For comparison purposes and to gauge how the market is doing, the university assigned a baseline index value of 1,000 to January 2005, a month that was near the apex of the residential housing bubble. Each month’s index can be compared to the previous month, year or market peak to understand the relative strength and direction of the Twin Cities housing market.

Here’s how things looked in November for the three categories of sales:

- Traditional sales -- The median sale price decreased from $189,600 in October to $185,500 in November, or 2.16 percent. The November price is down 8.62 percent from the November 2010 price of $203,000. The St. Thomas composite index for November was 881, compared to 893 in October and 919 in November 2010.

- Short sales -- The median sale price increased from $127,500 in October to $130,000 in November, or 1.96 percent. The November price is down 11.53 percent from the November 2010 price of $146,950. The St. Thomas composite index for November was 750, compared to 753 in October and 792 in November 2010.

- Foreclosure sales -- The median sale price decreased from $102,500 in October to $98,000 in November, or 4.39 percent. The November price is down 14.78 percent from the November 2010 price of $115,000. The St. Thomas composite index for November was 590, which is the same for October but down from 617 in November 2010.

Overall, the number of “closed” home sales in the metro area dropped from 3,364 in October to 2,600 in November; however, this year’s November sales were 12.4 percent higher than in November 2010.

“The hardest-hit segment continues to be homes that are in foreclosure,” explained Herb Tousley, director of real estate programs at St. Thomas. While the composite index for foreclosed homes did not change from October to November, when compared to April 2005 (near the apex of the residential housing bubble), the index has fallen 33.18 percent.

The percentage of distressed sales (short sales or foreclosures) increased for the second-consecutive month in November. The percentage was 43.68 percent in November and 40 percent in October.

“There are still a large number of foreclosures and short sales that need to clear the market in coming months,” Tousley said. “These sales will continue to have a depressing influence on the market as a whole.

“The traditional-sales segment of the market will bear watching through the winter and into the early spring,” he said. “We will not see a return to a healthier housing market until traditional home prices stabilize and start a sustained recovery.”

Charts and more details can be found on the Shenehon Center’s website. A free, monthly index via e-mail is available from Tousley at hwtousley1@stthomas.edu.

Research for the St. Thomas index was conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university.