Ho-ho is more like ho-hum, Twin Cities holiday shopping study finds

Although national surveys show that holiday shoppers plan to spend a bit more on gifts this year, here in the Twin Cities shoppers are leaning more toward ho-hum than ho-ho when it comes to opening their wallets.

Results of an annual study just concluded by three marketing professors at the University of St. Thomas’ Institute for Retailing Excellence show that shoppers in the Twin Cities will spend slightly less this year than last on holiday presents. That’s not exactly good news for retailers, since last year’s numbers also were somewhat flat.

Respondents to the sixth-annual Twin Cities area survey said they planned to spend 1 percent less on holiday presents than in 2006. National surveys, meanwhile, are predicting increases ranging from 2.5 percent to 5 percent, depending on the kind of store and category of gifts.

According to data collected and analyzed by researchers Dr. Lorman Lundsten, Dr. Dave Brennan and Dr. John Sailors at St. Thomas’ Opus College of Business, holiday spending will total $751 per metro-area household. That is down about 1 percent from last year’s $758. It also is the second lowest amount in the six years of the study, even without adjusting for inflation. In 2005, respondents said they planned to spend $750, in 2004 they said $796, in 2003 they said $779, and in 2002 they said $792.

“In the first three years of our survey, the Minnesota findings mirrored national predictions,” Brennan noted. “For the last three years, however, respondents to our Twin Cities survey said they planned to spend less, on a percentage basis, than the numbers reported in the national surveys.”

Based on the local responses and the population of the 13-county Minneapolis-St. Paul area, the researchers predict that the metro-region shoppers will spend $934 million on holiday gifts this year. “That is down $1 million from 2006, which is statistically insignificant,” Brennan said. “However, when factoring in the rate of inflation, the total estimated spend in 2007 will be 2 percent to 3 percent less than 2006. Last year, on the other hand, it was relatively unchanged from the prior year.”

This year’s total predicted spend of $934 million compares with $914 million in 2005, $959 million in 2004, $928 million in 2003, and $924 million in 2002. These numbers reflect the change in the metro region’s population, but are not adjusted for inflation.

Local vs. national surveys

The 1 percent decrease planned this year by Twin Cities households compares to a national 4 percent increase predicted by the National Retail Federation; a 2.5 percent to 4.3 percent increase (depending on store type) predicted by the International Council of Shopping Centers; and a 4.5 percent to 5 percent increase predicted by Deloitte & Touche USA.

According to the St. Thomas research, more households expect to spend more (14.5 percent this year compared to 10.3 percent last year), virtually the same expect to spend the same (58 percent this year compared to 57.5 percent last year), and fewer expect to spend less (27.5 percent this year compared to 32.1 percent last year).

The professors noted that their findings are based on what consumers predicted when they completed the surveys between Oct. 6 and Nov. 3. Actual spending might be different because shoppers could spend more or less than they planned once they get into the stores.

Unusually low survey response this year

The results of the study were based on a survey that was mailed to 3,000 Twin Cities-area households in 13 counties, including two counties in western Wisconsin. The households were selected to match the demographic characteristics of Twin Cities residents, including age, income, education and geography.

The researchers received 142 completed and usable surveys. The demographic characteristics of those who returned the surveys generally matched the characteristics of the original sample, and in turn, the characteristics of a cross section of Twin Cities residents.

The number of returned surveys, however, was less than half of the usual 300 to 400 responses. “We are at a loss to explain what amounts to a dramatic decrease in the response rate,” Lundsten said. “We conducted this survey virtually the same in every respect since 2002. The mailing was the same, the forms were the same, the letter of introduction was the same, and the demographic mix was the same. The only thing different was a response rate that was half the normal rate.

“With the exception of a few new questions that we add to the survey, we have purposely left it similar from year to year so that we can compare similar results from year to year. The more years we conduct the survey, the more powerful it becomes in spotting trends.

“We can only guess at the reasons for the downturn,” Lundsten added. “Possibly this reflects a lack of excitement for holiday shopping this year, which is reflected in the overall numbers.”

With the normal annual response of 300 to 400 returned surveys, the statistical margin or error for the holiday survey is about 3 percent one way or the other. Fewer responses increases the margin of error, especially in some of the question categories.

Because the demographic characteristics of this year’s returned surveys generally match the makeup of the Twin Cities, the researchers felt comfortable reporting data on broad questions, like how much the household plans to spend on holiday shopping, and what kinds of gifts will be purchased. However, the researchers did not feel the response rate was high enough to report data on which shopping malls will be visited most often by shoppers this year.

“This is unfortunate,” Lundsten added. “Where metro area residents like to shop has been some of our most interesting data. We are looking at ways of improving the response rate, and hope to be able to report this information in 2008.”

What will be under the tree this year

What will Twin Cities-area shoppers buy with their $751 this year? Lundsten uses a mathematical formula to analyze the relative popularity of a dozen gift categories. It sheds light on the “what’s hot” question and allows year-to-year comparisons.

The four most popular categories this year are clothing and accessories, books, gift certificates, and toys and hobby items. The four least popular categories are computers, jewelry, video games, and furniture and home furnishings. In the middle are consumer electronics, sporting goods, cash and entertainment.

These are close to last year’s results, with some notable exceptions. Cash and gift certificates, while still popular, showed the greatest declines in popularity over last year.

Cash went from third place last year to a tie for fifth this year, and gift certificates dropped from No. 1 last

year to No. 3 this year.

The category with the biggest increase is clothing and accessories, which went from No. 4 last year to the top of the chart this year. Despite news of lead paint and other recalls, the toy category moved up from fifth to fourth. Sporting goods moved from seventh to sixth.

Where we shop

According to survey results, the big, regional malls are holding their own as the most popular place for holiday shopping. This year, respondents said they would do 45.4 percent of their shopping at the malls, down slightly from 47 percent last year.

Non-mall stores showed a slight gain. They will receive 35.4 percent of the shopping dollars, up from 33.8 last year.

This year 6.8 percent of the planned holiday budget will be spent via catalog, telephone and phone shopping, which is down slightly from 7.2 percent last year, but down more significantly from 11.8 percent in 2004.

Internet shopping will capture 12.5 percent of the holiday dollar, up from 12.1 percent last year and 7.3 percent in 2002, the first year of the survey.

What the findings tell us

Based on this year’s survey, as well as other financial data, the St. Thomas retail researchers conclude that:

- Holiday price cuts, especially at large discount stores like Wal-Mart, were aggressive and early this year, starting in early October. Stores who don’t participate in the price cuts eventually will be forced to do so. It’s more difficult for smaller retailers to match the cuts offered by larger retailers.

- Even nationally, no one is predicting a stellar year for retailers. The deep discounting seen in early October signals a soft market.

- The Grinch who stole Christmas might be the gasoline pump, especially for those families who have less discretionary money for gifts.

- There is a move away from luxury gifts like high-end furniture, accompanied by a move toward more practical items like clothing and books. This indicates fewer shoppers for items with higher profit margins, and more shoppers for items with lower profit margins.

- The change is not dramatic this year, but the ongoing shift away from catalog sales and toward Internet sales continues.

- While they still remain popular, gift certificates and cash both took the biggest downward slide of the 12 gift categories tracked annually by the St. Thomas survey. This isn’t all bad news for retailers; the cards are purchased before the holidays, but are used to buy products after the holidays when merchandise often is discounted.

- A new question on the St. Thomas survey asked if last summer’s collapse of the I-35 bridge in Minneapolis would affect shopping plans. No change was detected.

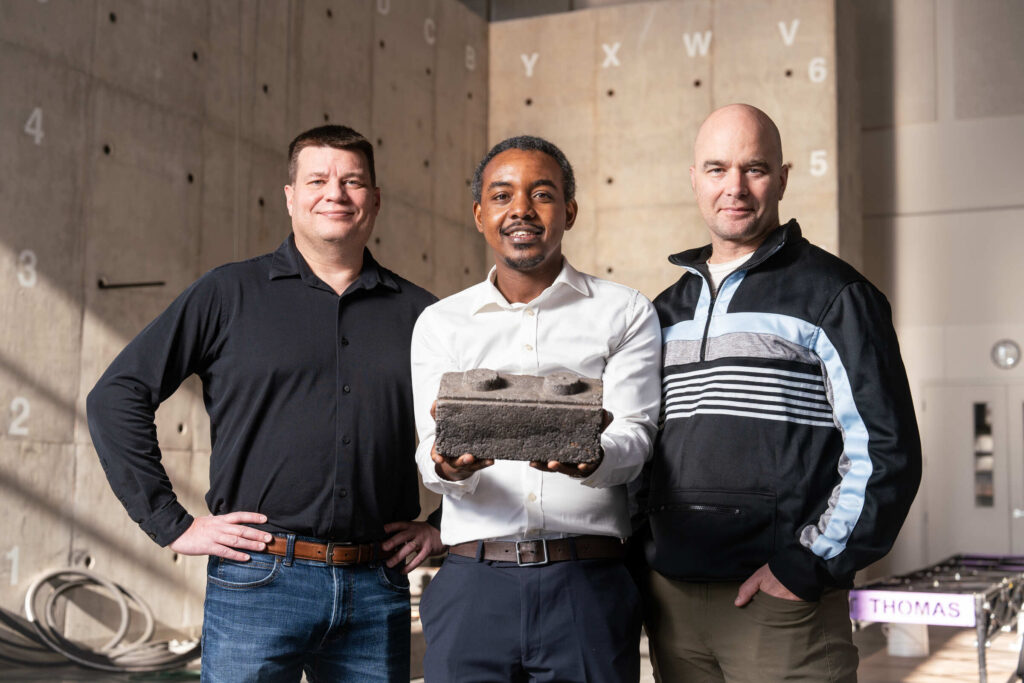

The researchers

Lundsten and Brennan are both longtime members of the Opus College of Business faculty. Sailors joined the faculty in 2005.

Lundsten is a professor of marketing and chairs the university’s Marketing Department. He holds a doctorate from the University of Michigan.

Brennan, who holds his Ph.D. from Kent State University, is a professor of marketing and co-director of the university’s Institute for Retailing Excellence.

Sailors is a specialist in consumer behavior, marketing research, and brand equity and loyalty; his doctorate is from Northwestern University.

The Institute for Retailing Excellence, part of the St. Thomas College of Business, conducts research and offers educational programs for those who work in retailing.