Would a predicted increase in mortgage interest rates, coupled with a low-inventory-fueled jump in home prices, be enough to kill the housing recovery that has been under way in the Twin Cities for the last two years?

That question is examined in the February Residential Real Estate Index, a monthly analysis of the 13-county metro area prepared by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

Even with a potential increase in both interest rates and the asking price of homes, “the housing market may slow down but the recovery will not be derailed since home ownership will remain affordable for most households,” according to Herb Tousley, director of real estate programs at the university.

What might happen to mortgage rates?

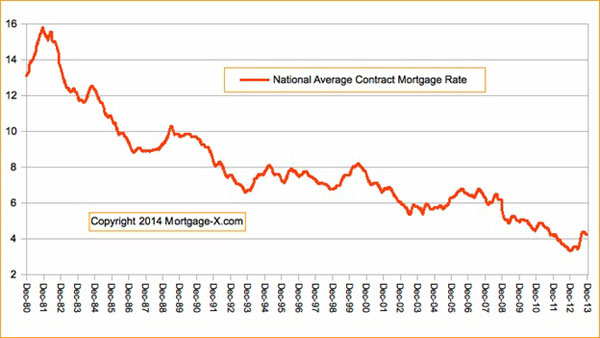

According to many sources, interest rates and mortgage rates are expected to increase moderately during the course of 2014. “Mortgage rates have been extremely low for the last several years and at some point they are going to have to return to more historically normal levels,” Tousley said. A chart showing the change in mortgage rates since 1980 can be found below and on the Shenehon Center’s website.

What might happen to home prices?

The number of homes for sale continues to remain at a historic low level with just 12,131 properties for sale in the 13-county metro area.

“We will be keeping a close eye on the inventory because the number of homes for sale will have a direct impact on the percentage of increase in median sales prices during 2014,” Tousley said. “We have been expecting an increase in inventory of homes for sale in the 15 percent to 20 percent range as we move into the spring and summer selling seasons due to a healthy increase in sale prices over the past year and generally improved economic conditions in the region.

“If inventory levels remain stubbornly low throughout the year, the lack of supply will cause prices to increase more aggressively.”

Will homes remain affordable?

“If mortgage rates do increase moderately as expected in 2014, home ownership will still remain affordable for Twin Cities residents,” Tousley said.

“Home ownership in the Twin Cities has traditionally been very affordable compared to many other areas of the country,” he added. In Minneapolis-St. Paul the home-price-to-income ratio (the median sale price of a home compared to the area median household income) as of December 2013 was 2.97 compared to the national average of 3.86.

A chart on the Shenehon website illustrates the impact of potential increases in mortgage rates and asking prices. For an example, the chart assumes: a current mortgage rate of 4.5 percent increasing to 5.5 percent by year-end; a 5 percent increase in the median home sale price; a 2 percent increase in median household income for a buyer who puts 5 percent down.

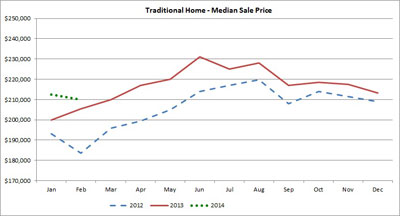

In this case, the median sale price in February 2014 of $213,250 would increase to $223,912 by December 2014. During that time, meanwhile, median household income would increase from $63,564 to $64,835. When principal, interest, insurance and taxes are added to the mix, the monthly payment increases from $1,326 to $1,507.

As a result, the debt-to-income ratio in this case increases from 25 percent in February to 28 percent in December.

“Payments do increase,” Tousley said, “however they remain within most mortgage lenders’ guidelines that the total payment is at or less than 28 percent of household income. Under this scenario, homeownership will remain affordable for most households.”

How the Twin Cities market looked in February.

February’s severe weather “continued to have an outsized dampening effect on the Twin Cities’ housing market,” Tousley said.

Median sale prices were essentially flat and sales volume was down slightly. The percentage of distressed sales (foreclosures and short sales) ticked up slightly to 30 percent in February, but an improvement over the nearly 44 percent recorded in February 2013.

“If all this sounds a lot like the report from December and January, there is a good reason for that,” Tousley said, “but look for things to improve in March as the spring selling season gets underway.”

The UST indexes

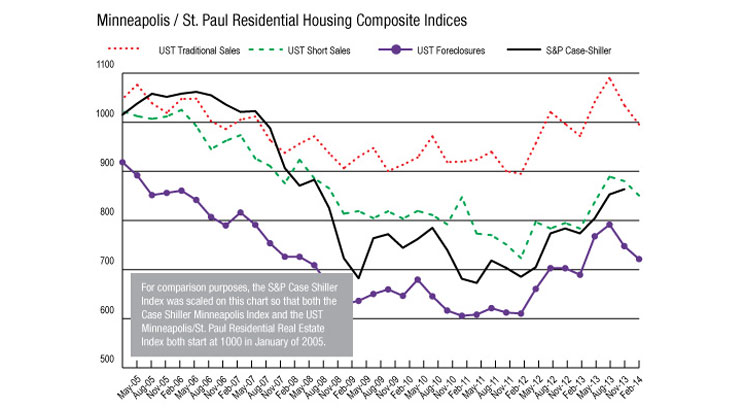

Each month the Shenehon Center tracks nine housing-market data elements, including the median price for three types of sales: nondistressed or traditional-type sales, foreclosures, and short sales (when a home is sold for less than the outstanding mortgage balance).The St. Thomas Traditional Sale Composite Index continued to decrease, moving from 1,005 in January to 995 in February. Despite the monthly decrease, the index remains 2.9 percent above the level recorded in the previous year.

The short sale index was 851 in February, down 10 points from January; however, it was a 9.24 percent increase compared to one year ago.

The foreclosure index also decreased in February, moving from 726 in January to 721 in February, a decrease of .7 percent. The index is up 5.68 percent compared to January 2013.

More information online

The Shenehon Center’s charts and report for February can be found here.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley at hwtousley1@stthomas.edu.