Leaders in the field of Minnesota commercial real estate don’t foresee drastic changes in their industry over the next two years. What they do predict is relatively slow growth and gradually improving conditions.

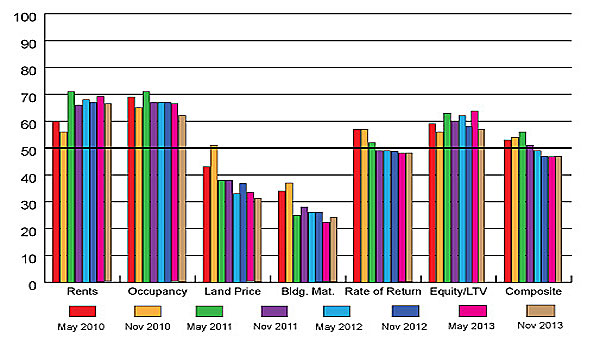

That is the theme of the eighth Minnesota Commercial Real Estate Survey, a semiannual poll of 50 Minnesota commercial real estate leaders from the fields of development, finance and investment.

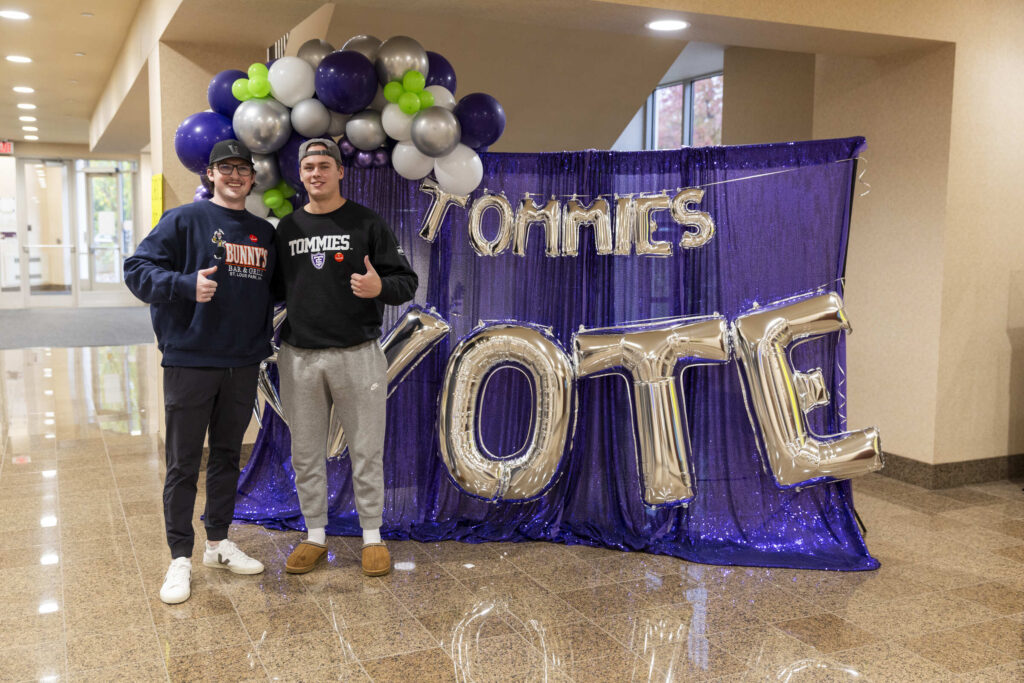

The survey has been conducted each fall and spring since 2010 by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

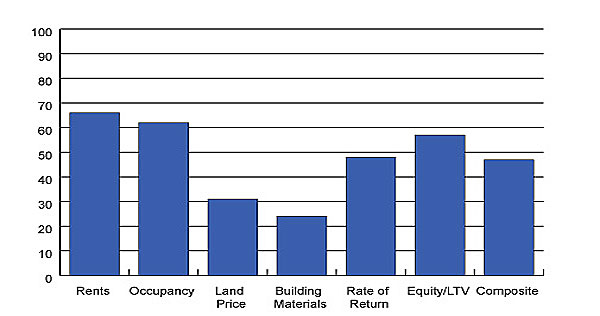

In all eight surveys the same group of 50 industry leaders have been polled on their expectations of future commercial real estate activity. Their responses are used to create index scores that can be compared over time. Scores higher than 50 represent a more optimistic view of the market over the next two years; scores less than 50 represent a more pessimistic view.

The November 2013 composite score stands at 47 and continues a “slightly less than optimistic” trend for the third-consecutive survey.

“This fall’s results reflect a mixed bag of optimism in some areas and pessimism in others,” said Herb Tousley, director of real estate programs at the university. “This is similar to the pattern that was observed last spring; however, the degree of optimism and pessimism has become slightly more moderate.”

Price for Space

The index score for rental rates remains positive but dropped slightly, from 69 to 66, as did the index for occupancy levels, which moved from 66 to 62. “Despite the decrease, the panelists remain optimistic that rents and occupancy levels will continue to improve, albeit at slower rates,” Tousley said.

This marks the fifth-consecutive survey with scores above 60 in these two areas, indicating, he said, “continued optimism that the economy is going to continue to improve and there will be a greater demand for space.”

Land Prices

The land-price index dropped from 33 last spring to 31 this fall. It was the third-consecutive decrease and, Tousley said, “reveals a strong expectation that land prices will continue to increase.

“Increasing land prices increase total project costs and are a hindrance to new development, making it more difficult to obtain financing and adequate returns for investors.”

Building Materials

The building-material index moved from a strongly negative 22 to a slightly less negative 24.

“That reflects the panel’s opinion that building-material price increases are expected to moderate,” Tousley said. “An improvement in prices will be favorable for future development.”

Return for Investors

The index for investors’ returns has remained at 48 for the past four surveys. That is seen as essentially neutral and indicates the panel does not see a significant change in expected returns over the next two years.

“Investors will continue to seek out quality investments but they are being much more diligent about how they price risk and evaluate return,” Tousley said.

Required Equity

The index for the amount of equity required by lenders dropped significantly, from 64 to 57.

“This indicates the panel’s belief that credit will be available for good projects but lenders will increase their equity requirements in the coming two years,” he said.

Accuracy

With eight surveys completed since the Minnesota Commercial Real Estate Survey began in 2010, the researchers compared the panel’s past predictions with how things actually turned out.

It turns out that market conditions in 2013 are very close to what the panel predicted in 2011. Some examples:

- In 2011 the panel predicted higher rents in 2013. Net rents for class A office property in the Twin Cities went from $14.88 per square foot in 2011 to $15.74 in 2013.

- In 2011 the panel predicted higher occupancy in 2013. The average retail vacancy in the Twin Cities went from 8.4 percent in 2011 to 7.8 in 2013.

- In 2011 the panel predicted higher costs for building materials in 2013. The price for lumber increased from $252 per 1,000 board feet in November 2011 to $396 in November 2013.

Summary

“Panelists don’t see any drastic changes in the next two years,” Tousley said. “It can be interpreted that things will continue to progress forward, but at a slightly slower pace due to higher development costs in land and materials.

“Overall, our panelists do not foresee a commercial real estate recession coming in this market, but we will likely see two years of relatively slow growth and gradually improving conditions in the commercial real estate market in the Twin Cities.

“One thing we have observed in the current survey is there is less variation in the responses and that has caused a more uniform response rate reflecting the panel’s certainty in their views.”

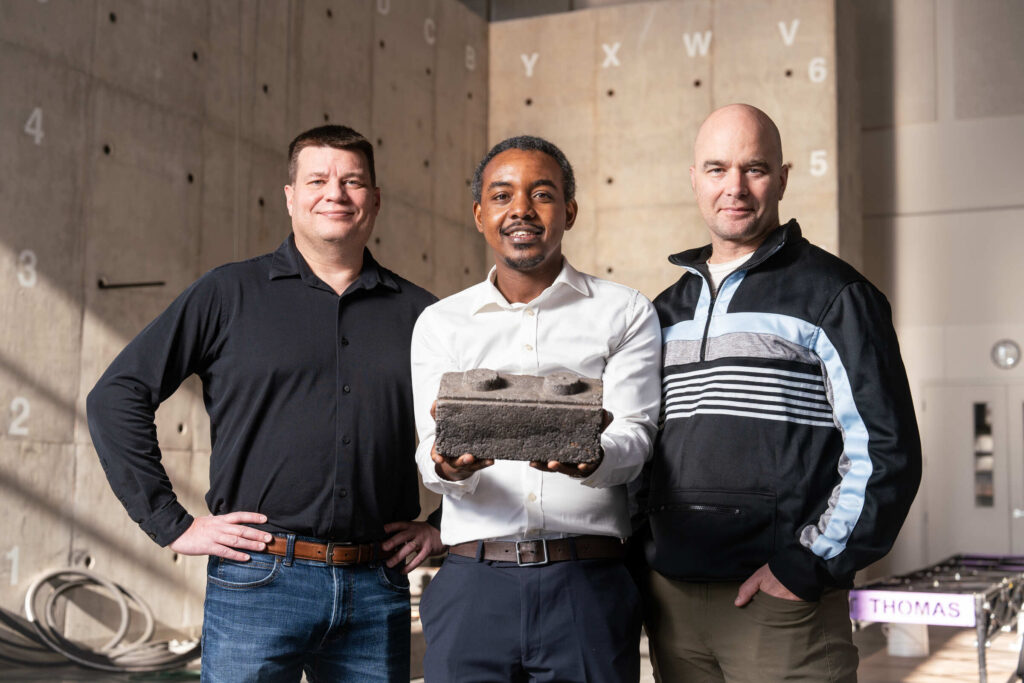

The survey is conducted and analyzed by Tousley and Dr. Thomas Hamilton, associate professor of real estate at St. Thomas. Additional details can be found on the Shenehon Center’s website.