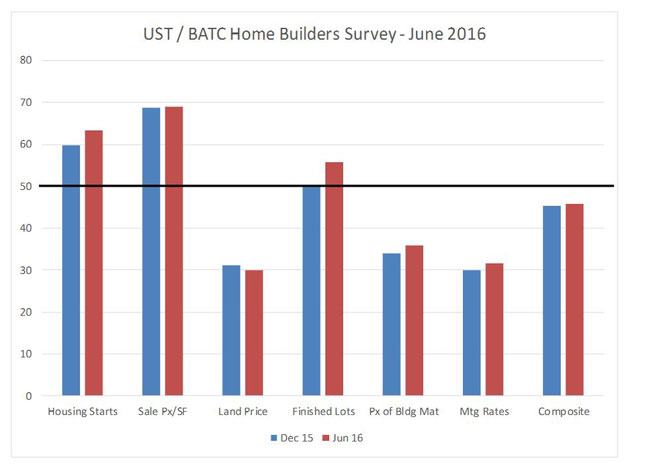

Leaders in the Twin Cities single-family-home-construction industry were “slightly less pessimistic” about market conditions in June than they were last December. That’s according to a survey conducted by the University of St. Thomas Shenehon Center for Real Estate in partnership with the Builders Association of the Twin Cities (BATC).

Last December’s survey produced a composite index of 45. The second survey, conducted in June 2016, produced a slightly more optimistic 46.

The Twin Cities Home Builders Survey is patterned after St. Thomas’ Minnesota Commercial Real Estate Survey that began in 2010. The home builders survey polls the same panel of 35 industry leaders every six months about their expectations in six key areas of the housing market one year in the future. The first survey was conducted in December 2015.

“The participants were strongly optimistic in their expectation of increasing sale prices per square foot and the number of single-family housing starts, and they were moderately optimistic about an increase in availability of finished lots in the coming year,” said Herb Tousley, director of Real Estate Programs at the University of St. Thomas.

“However, the expectation of increasing land prices and a belief that the cost of building materials will increase over the next year was a cause for concern that tempered the composite index,” according to David Siegel, executive director of BATC.

“Increasing prices of land and building materials increase total building costs, which in turn creates a drag on single-family housing construction and is reflected in the survey as a pessimistic score. There is also an expectation that mortgage rates are going to increase moderately over the next year. This is also reflected pessimistically in the survey as it adds to the total cost of purchasing a home,” Siegel said.

Tousley noted that these first two surveys are providing a baseline to compare with future surveys. “As we accumulate more survey results over the next few years, the results will begin to reveal market trends that will be useful as a forecasting tool,” he said.

“The industry leaders we poll are actively engaged in studying both the demand and supply side of the housing market,” Tousley said. “Since they are involved in creating new housing units and adjusting supply-to-demand conditions, these individuals are close to the actual changes taking place in the market.”

These experts are asked to assign a number of zero to 100 for each of the six questions. A midpoint score of 50 is neutral; scores higher than 50 indicate a more favorable outlook and scores lower than 50 indicate a more pessimistic outlook. The survey also provides a composite score, or overall average, for the six questions.

Here are the scores for each of the six questions:

Housing starts: 63 (up 3 from December)

This score indicates an increasingly optimistic expectation by the panel that the number of new single-family housing starts will increase in the coming year.

Square-foot sale price: 69 (same as December)

This reflects the panel’s strong belief that sale prices will be significantly higher a year from now. The net result is the expectation that when compared to previous years, 2016 will be a much better year for single-family home builders.

Land prices: 31 (up 1 from December)

This pessimistic score changed little from the first survey in December. The score reflects a belief that the rate of increase for land prices is going to be greater than the rate of increase for home prices in general.

Availability of finished lots: 56 (up 6 from December)

This indicates an increasing optimism that there will be more finished lots available over the next 12 months. That’s a good thing for the market because it helps moderate land prices and encourages more construction.

Cost of building materials: 36 (up 2 from December)

Like land prices, this score is just slightly less pessimistic and continues to reflect a concern that some of the gains from increased sale prices and more building starts could be offset by the higher costs of building materials.

Mortgage rates: 32 (up 2 from December)

This reflects the panel’s expectation that mortgage rates are going to increase moderately over the next year. Most panelists are expecting an increase of .5 to 1 percent.

More information

Additional details can be found on the Shenehon Center’s website.