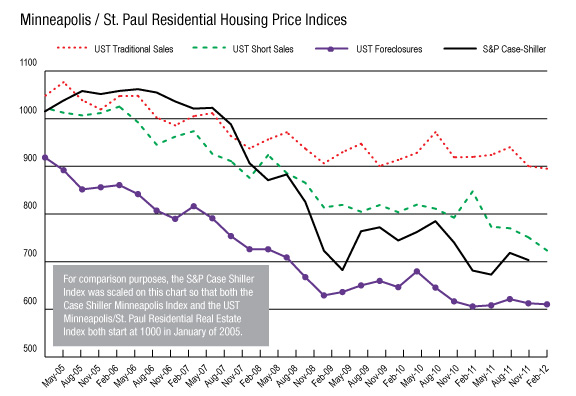

When it comes to the high number of foreclosed and short-sale homes now on the market in the 13-county Twin Cities area, there is good news and bad news, according to an analysis released today by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

The bad news is that the percentage of foreclosures and short-sales (homes sold for a price less than the outstanding mortgage balance) continues to remain at historically high levels. In January, 55 percent of all homes sold in the Twin Cities were distressed sales; in February it climbed to 57 percent.

In six of the last 12 months, more than half of the homes sold in the Twin Cities have been distressed sales, and this level continues to have a dampening effect on median prices, according to Herb Tousley, director of real estate programs at St. Thomas.

The good news is that it appears a settlement is now in place between the federal government and the five major banks involved with robo-signing and other foreclosure practices. “Having more clarity around this issue means that lenders will now process distressed properties more rapidly,” Tousley predicted. “This certainly will mean more pain in the short term.”

Those who have been following the Shenehon Center’s monthly Residential Real Estate Price Report Index know that for the market to right itself, the supply of distressed sales must return to more normal levels.

“The remainder of the distressed properties need to be sold and clear the market before a meaningful recovery can take place,” Tousley said in this month’s report on the metro real estate market.

That analysis also found that the median price for a traditional home (not a foreclosure or short sale) decreased sharply in February after recording a slight gain in January. The month-to-month drop was 4.8 percent (from $193,000 in January to $183,700 in February) while the year-to-year drop was 11.2 percent (from $207,000 in February 2011 to $183,700 in February 2012).

Why the drop, especially after things were looking a little brighter in January? The analysts dug deeper into the statistics to look for an answer. One factor, they found, is the mix of properties sold in February compared to January.

There was a shift: the percentage of higher-priced single-family homes decreased in February, while the percentage of lower-priced condos increased. The percentage of single-family homes, with a median price of $200,000, dropped 3.6 percent (from 79.4 percent in January to 75.8 percent in February) while the percentage of condos, with a lower median price of $111,000, increased 3.9 percent (from 6.8 percent in January to 10.7 percent in February). The percentage of town homes sold in February, meanwhile was relatively unchanged, at 13.5 percent in February.

“Look for the median price of traditional sales to increase in coming months as these percentages return to more normal proportions,” Tousley said.

The number of traditional homes on the market in the Twin Cities continues to remain at historic low levels. In February there were 16,764, down from 22,937 in February a year ago. While part of the low number has to do with the seasonal nature of the market, another likely reason is that some homeowners are waiting for prices to go up before trying to sell their home.

New listings are an indicator of the future supply of homes on the market. “The number of new listings of traditional homes for the last 90 days is a mirror image of the same period a year ago,” Tousley said. “Look for more homes to come on the market as spring approaches.

“The supply of homes for sale will not increase to more robust levels until the median sale price of traditional sales starts to improve and more of the discretionary sellers decide to put their homes on the market,” he said.

St. Thomas has developed an index that uses nine data elements to track the health of the traditional, foreclosure and short-sale markets. While the index has dropped 2.61 percent over the past year for traditional-sale homes, and has been stable for foreclosures, it has dropped 14.54 percent for short-sale properties. More details can be found on the Shenehon Center’s website.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley at hwtousley1@stthomas.edu.