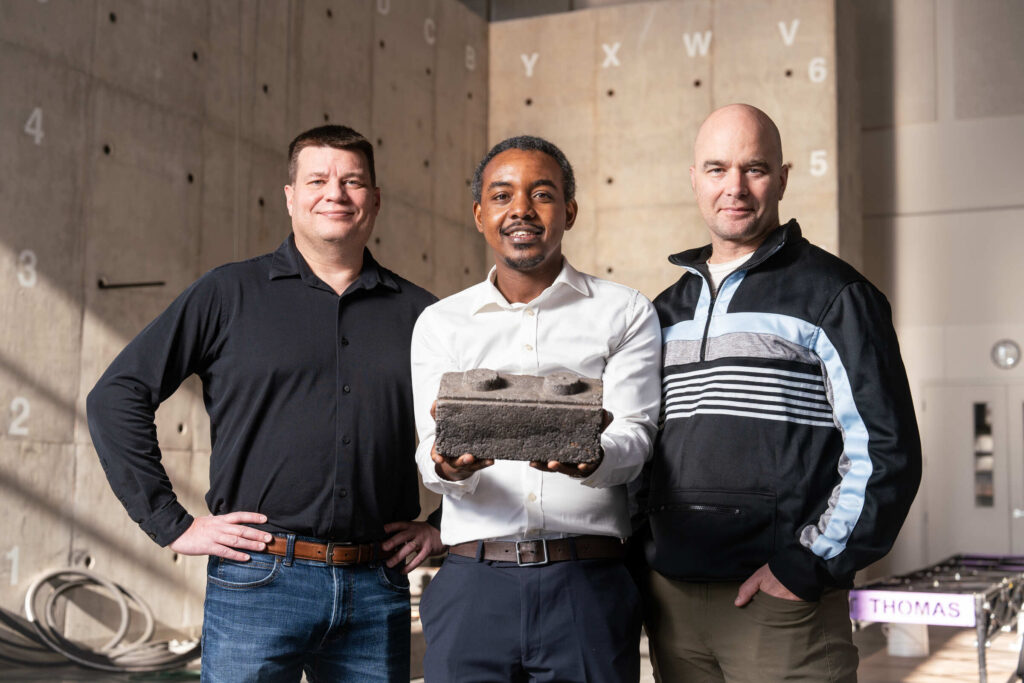

Tyler Schipper, an economics associate professor at the University of St. Thomas College of Arts and Sciences, recently spoke with Cheddar about why the Federal Reserve is cutting interest rates for the first time in over two years, as inflation falls.

From the story:

For insight, Big Business This Week spoke with an excellent translator of arcane monetary policy: Tyler Schipper, a professor of economics at the University of St. Thomas in Minneapolis-St. Paul.

What’s prompting the Fed to finally cut rates? This week’s report that inflation is down to nearly 2%?

This is the lowest we’ve seen inflation since February of 2021. The numbers have been going down, and it’s giving the Fed the confidence they need to start making rate cuts. In fact, the conversation you will likely see out of the meeting next week will be less about inflation and more about the risks to the job market. Remember, on monetary policy, the Fed has a dual mandate: maintain stable prices, which they interpret as 2% inflation, and maintain the highest level of employment that doesn’t cause inflation.

There’s been a lot of criticism that the Fed waited too long to cut rates, driving up prices and the costs of credit and crimping the housing market in particular.

The Fed has been very cautious because they want to see this inflationary dragon dead for sure before they cut rates. I think if they had kept rates at 3% to 5%, inflation would have come down anyway, because we were facing supply-side pressures (as a result of the pandemic disruptions). That’s why we had the pandemic stimulus, to help people get by as prices shot up. Maybe the Fed could have acted a little faster, but we were asking them to respond to a macroeconomic event (the pandemic) they’d never seen before and didn’t have many data points to draw from.