On a given weekday morning in downtown Chicago, Dan Huber and Bob Murray don jackets (tan and white mesh for Dan, black and maroon for Bob), attach ID badges HDP and RMU, grab smart phones and go to work in small, raised amphitheaters about 30 yards apart.

Both are keenly aware of one thing: dusk is descending on what it is they do. They are among the last of the “open outcry” traders on the Chicago Mercantile Exchange. For the next four hours they will buy and sell corn and wheat options in face-to-face, stand-up bargaining that will determine price and eventually affect what you pay for products like ethanol gas and bread. And despite the shouting, the gesticulating, the body contact, the sweat, and the emotion riding on huge financial risk, neither would, for one moment, give up what they call “the game.”

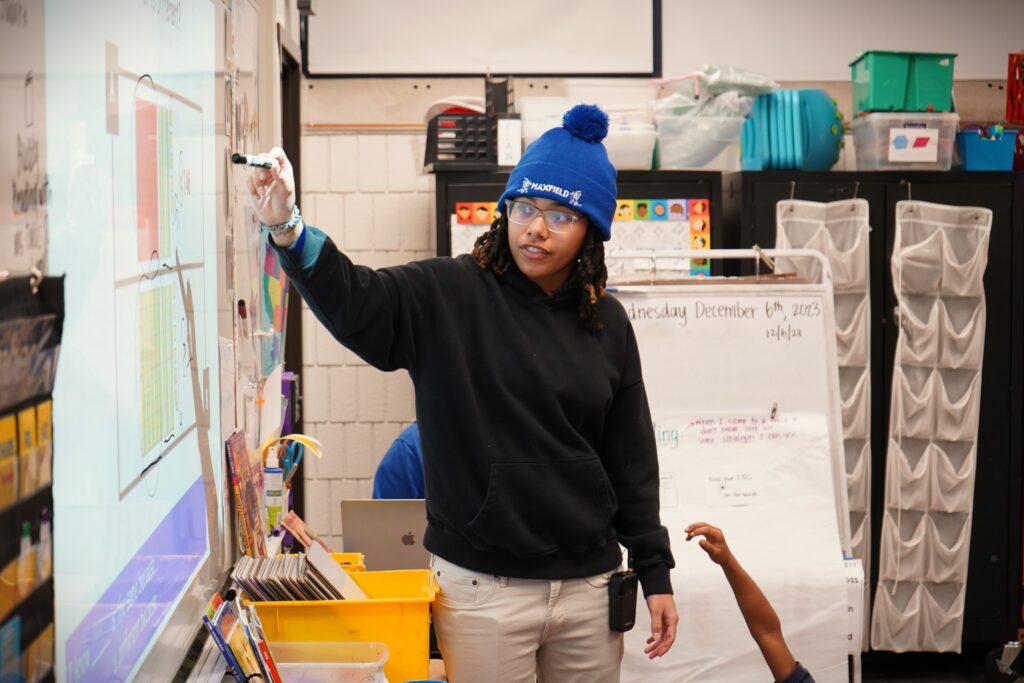

Bob Murray '86 (left) and Dan Huber '89 were already some of the last people doing outcry trading at the Chicago Mercantile Exchange where they were photographed in 2010.

It takes an independent, disciplined mind to be a pit trader, and Huber (right) had to nurture these traits as a boarder at St. Thomas. His father, who worked for the agribusiness giant Cargill, was transferred to Switzerland when Dan was a high school senior, leaving him without a family, apart from the tight community of Ireland Hall, headed by Father James Lavin. Huber intended to use St. Thomas as a stepping-stone school, but “fell in love with the place.” He majored in business and got his first taste of the jostling fraternity he would later relish in the pit by competing in several intramural sports.

Murray grew up in a western suburb of Chicago, the oldest boy among 13 children. His father was a pit trader, followed on the floor by six sons. Bob also majored in business at St. Thomas, where a teacher, Martin Fischer, introduced him to the intricate world of agricultural economics. He played no sports at St. Thomas, but living in an off-campus house with six other students presaged the macho, close-quarters life of the pit, complete with badinage.

Dan, 44, and Bob, 46, and their families live in North Shore Chicago communities. Their retired fathers have known one another for many years, and now their sons, who met only after they started trading, have inherited their friendship. Their wives – Kristen Huber and Barbara Murray – are friends. Their children play together. From their trading pits, the two can see one another at work – the only question is for how much longer.

Both began pit trading in grain immediately after graduation, and they are still there: 21 years in corn for Dan, 24 in wheat for Bob, who is a third-generation trader. His grandfather was in soybeans from the 1930s into the 1950s, and his father traded corn for 40 years. Dan’s father also provided an introduction to trading by affording him a January Term opportunity to earn college credits working on a Cargill trading desk in Geneva, Switzerland.

The longevity of Huber and Murray on the Merc trading floor, one of the world’s largest, is all the more remarkable because attrition in their field is about 90 percent. Both are used to once-familiar faces suddenly absent from the chaotic pit, casualties of the alcoholism, substance abuse and gambling that can accompany the daily rush of adrenalin; or they are simply victims of having their nerves or capital tap out. Indeed, money management is a key skill of the successful options trader. Huber recalls loans from friends or family in the early going. He described himself as “conservative with money; I like putting it in the bank.”

Murray’s father told him, “Never get too high with success, nor too low with failure,” a caution about the inevitable ups and downs of pit trading. “The best traders know how to take a loss, get up off the floor and move on,” Murray commented. “It’s one of the first things you have to learn.” Rarely, a losing trader moves on in a way not recommended. Huber recalled one whose clearing firm had to clean up a $20 million dollar mess after he left the building … and the country.

While the two St. Thomas graduates have baccalaureate degrees, trading does not necessarily favor the formally educated. What it does reward is a kind of poker smarts, honed on the split-second ability to read the market and one’s bidding partners.

“There are no timeouts once the bell rings,” noted Huber. It’s a comparatively primitive way to buy and sell. Day-to-day it can be a grind, but there is always the lure of competing mano-a-mano for significant financial stakes. Emotion runs high. Huber and Miller have witnessed traders grabbed by their ties and others stabbed with pens. At times, an altercation on the pit floor might continue outside the building, but as Murray (right) is quick to point out, “Most are a lot like hockey fights, with both combatants wanting nothing more than to be broken up.”

The pit trading fraternity is a curious one. On the one hand, you are colleagues in the same profession; on the other hand, it’s a zero sum confrontation. For every winner there is a loser in the same pit. In a way, it’s a community of the vulnerable. Everyone knows he (it is virtually an all-male society) will be on the losing end some days, and that softens the urge to kick a man who is down, monetarily and psychologically.

“Buddies will sometimes try to cheer you up at the finish of bad day,” said Huber. “At the end of the day, win or lose, I feel tight with friends in the pit,” echoed Murray.

The pit as a trading venue goes back to the 19th century, and its commerce is grounded in a lighting-fast sign language called “arb” (short for arbitrage, the exploitation of price discrepancy). Developed largely in Chicago, arb facilitates communication in large pits where cacophony rules. For example, the palm of the hand facing inward means you want to buy, facing outward means you are selling. Price is indicated by manipulating fingers, quantity by touching the face in various ways. Over short distances, arb can be a very efficient way to communicate, either with others on the pit floor or with team members off the floor. Like the options trading it facilitates, arb is threatened by the digital age and is on the way to being a lost language. Despite arb, there is plenty of shouting in the pit, which is why it is called “open outcry trading.” In large pits, the noise level can be as harmful as rock music on an MP3, and traders’ hearing often diminishes over the years. The vocal cords are strained as well. A sore throat is a nuisance to the average person, but its potential for laryngitis is a threat to the livelihood of a pit trader. The pit trader believes in the maxim, “A healthy mind in a healthy body.”

Alum Dan Huber ('89) raises his hand and shouts an order on the floor of the Chicago Merc Dec. 2010

“You’d better have a game face on and a strategy prepared, or you will get run over,” is the way Huber put it. Both Dan and Bob emphasize healthy lifestyles. They work out, jog and watch their diets. Huber is a six-handicap golfer. Murray works off energy coaching youth sports, and with five boys ages nine to 17, he does not lack for opportunity.

The support of family, especially of spouses, is paramount in avoiding depression. “Family, friends, faith in God – these are things you always have on days when you are humbled,” said Huber. On a losing day, Murray decompresses on his 45-minute train ride home to Wilmette. “When I get home, I get unusually quiet. I try to calm down,” he said.

As if pit traders needed another challenge, they are currently faced with an uncertain future. The Internet keeps eroding traditional trading. Huber and Murray have personal markers of the shift to computer trading since the heyday of the pit in the 1970s and 80s. The Minneapolis Grain Exchange, the subject of Huber’s senior project at St. Thomas, shut down pit trading in December 2008. Five of Murray’s brothers have moved from the floor to electronic trading, and three are still at the computer. Huber and Murray have watched as grain futures trading at the Chicago Merc has morphed electronic. While option trading in those commodities remains, for now, in the pit, many experts predict the days of open outcry are numbered.

If that day comes, Huber admitted he “will miss the excitement and camaraderie that the floor brings. I have trained myself to react to certain things in the pit and make split-second decisions [that] I do not think you can reproduce on a computer screen. But life in the pit has always required flexibility and adjustments, so I will adapt.”

Murray is “still not positive” what he would do if the pit closes, although he is “pretty sure I would start trading futures electronically.”

Until then, the two will still be “in the game.”

Read more from St. Thomas magazine.