An analysis of the 13-county Twin Cities real estate market for August found a healthy decrease in the number of foreclosures along with a stronger demand for moderately priced homes than for higher-priced homes.

Each month the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business looks for real estate trends in the Twin Cities and tracks the median price for three types of sales: nondistressed or traditional-type sales, foreclosures, and short sales (when a home is sold for less than the outstanding mortgage balance).

“During the early part of this year the percentage of distressed sales was hovering near 30 percent,” said Herb Tousley, director of real estate programs at the university. “In August, the percent of distressed sales was 10.6 percent, a level not seen since mid-2007. More importantly, the number of new foreclosures continues to drop; that means there should be even fewer distressed sales in the next 12 to 18 months.”

After a persistent period of l0w inventory, the number of homes available to purchase has increased to 18,205. That compares to 16,747 in August 2013 and is now near pre-housing-crash levels.

After a persistent period of l0w inventory, the number of homes available to purchase has increased to 18,205. That compares to 16,747 in August 2013 and is now near pre-housing-crash levels.

“The increase in the number of homes for sale will result in a better balance between buyers and sellers,” Tousley said. “Buyers will have more choices as the market moves from a seller’s market to a normal equilibrium.”

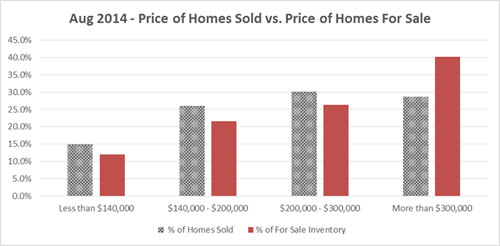

Another trend the Shenehon Center follows is the number of homes available in different price brackets. By comparing the asking price of homes in the Twin Cities and how many were sold, the Shenehon Center found a stronger demand for homes priced under $140,000 than homes listed at $300,000 or higher.

Home prices in August

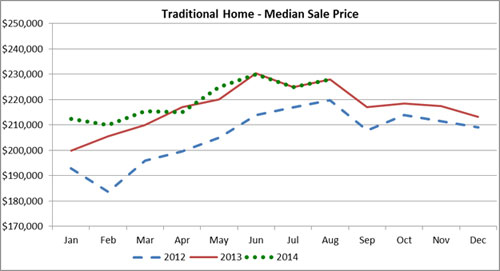

Median sale prices for the Twin Cities recovered in August from a slight decline observed in July. The median price of a traditional (nondistressed) home increased to $228,000 in August, close to the high-water mark for the year set in June at $229,900.

Compared to August of last year, the sale price for a traditional home is up 5.3 percent in 2014.

Overall, the number of closed sales in August was down 7.3 percent compared to the same month a year ago, but it’s not all bad news because most of the decrease was due to a sharp decline in the number of distressed sales. Compared to last year, August saw a 4.6 percent increase in traditional sales, a 58 percent decrease in short sales, and a 50 percent decrease in foreclosure sales.

Overall, the number of closed sales in August was down 7.3 percent compared to the same month a year ago, but it’s not all bad news because most of the decrease was due to a sharp decline in the number of distressed sales. Compared to last year, August saw a 4.6 percent increase in traditional sales, a 58 percent decrease in short sales, and a 50 percent decrease in foreclosure sales.

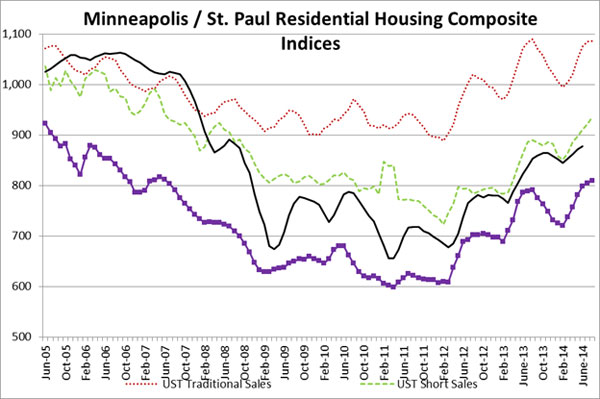

The UST composite indexes

Each month the Shenehon Center tracks nine housing-market data elements, including the median price for three types of sales, and creates an index for each: nondistressed or traditional-type sales, foreclosures, and short sales.

The composite index for traditional sales moved up just one point in August, to 1086, but it’s a new yearly high and reflects the strong market for traditional sales seen in 2014.

The composite index for short sales was 936 in August, up 14 points from July. It also is up 5.3 percent compared to one year ago. “Look for the short sale index to play a less significant role in our analysis as the number of short sales drops below 3 percent of the total monthly sales,” Tousley said.

The composite index for the foreclosure market moved from 804 in July to 810 in August. The index is 2.3 per cent higher when compared to August 2013.

More information online

The Shenehon Center’s charts and report for August can be found on its website here. The index is available free via email from Tousley at hwtousley1@stthomas.edu.