The Shenehon Center’s August report

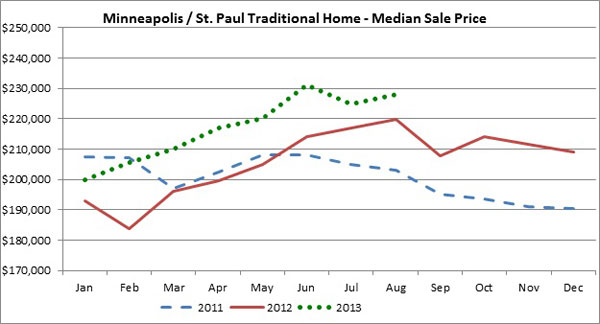

The monthly increases seen in the price of traditional homes (those not under threat of foreclosure) in the Twin Cities real estate market are beginning to moderate as recent sale prices approach the pre-housing-crash prices recorded back in 2006.

According to the Residential Real Estate Price Report Index, a monthly analysis of the 13-county metro area prepared by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business, the August median sale price for a home not affected by foreclosure was $228,000. That’s up 1.38 percent from July and is approaching the pre-crash peak of $239,900 in June 2006.

Each month the Shenehon Center tracks nine housing-market data elements, including the median price for three types of sales: nondistressed or traditional-type sales, foreclosures, and short sales (when a home is sold for less than the outstanding mortgage balance).

In his analysis for the month of August, Herb Tousley, director of real estate programs at the university, said that “we are also continuing to see the median price of short sales and foreclosed sales close the gap with traditional, nondistressed sale prices. This is a healthy trend as the price gap between foreclosed sales and traditional sales has returned closer to pre-crash levels.”

Overall in the Twin Cities, distressed sales represented 20.68 percent of homes sold in August 2013. Compared with the same period in previous years, that’s far higher than the 1.17 percent in August 2005 but less than half the 44.96 percent recorded in August 2011.

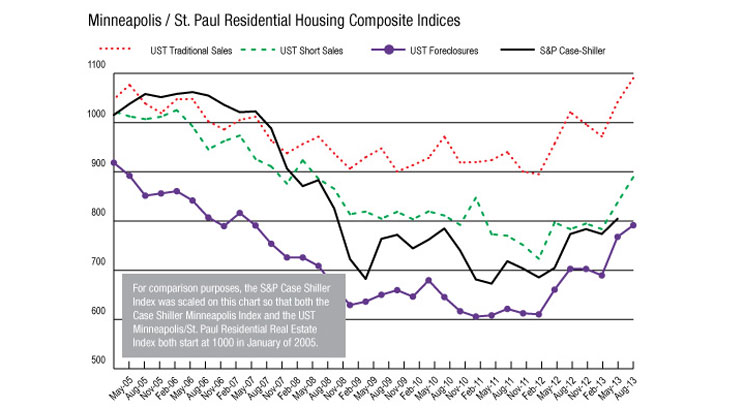

The St. Thomas Traditional Sale Composite Index, the one that tracks nine data elements, now has reached 1,090; that tops its previous highest recorded level of 1084 that was set in August 2005.

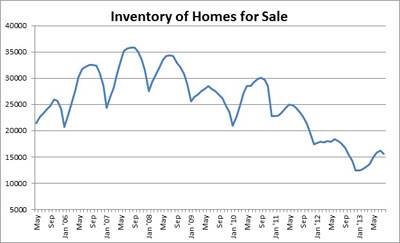

“This is a reflection of the sustained recovery of traditional home median sale prices and a number of other favorable market factors, including low levels of inventory, the decreasing percentage of distressed sales and historically low interest rates,” Tousley said.

Composite indexes for the distressed sales also are improving. The foreclosure index for August 2013 of 792 is up 12.8 percent from August 2012. The short sale index for August 2013 of 889 is up 13.2 percent from August 2012.

Last year the Twin Cities saw the construction of 5,750 new homes, and this year that number is expected to be 6,500 to 6,800. While an improvement over levels seen in recent years, it is far below levels seen in the early 2000s.

One potential problem is that the number of available vacant developed lots is running 12 percent below last year. Some builders may find themselves constrained due to a shortage of vacant developed lots. That is putting upward pressure on land prices and likely will lead to increased levels of land development.

One potential problem is that the number of available vacant developed lots is running 12 percent below last year. Some builders may find themselves constrained due to a shortage of vacant developed lots. That is putting upward pressure on land prices and likely will lead to increased levels of land development.

Meanwhile, the Twin Cities has added approximately 40,000 new jobs in the past year and the unemployment rate is now 5.2 percent. Comparing job growth to housing supply gives you what is called the “E/P” ratio, or employment-growth-to-housing-permit ratio. Nationally, this ratio is 2.5, which means there are typically 2.5 jobs per household.

Applying that ratio to the 40,000 new jobs created in the Twin Cities in the past year indicates a need for 16,000 additional living units. But, as mentioned above, the metro area is expected to add about 6,500 new single-family homes, in addition to about 4,000 multi-family units.

“The bottom line for 2013 is that there will still be unmet housing demand in the Twin Cities,” Tousley said.

He predicts that “as long as interest rates remain steady, look for the number of closed sales to continue to exceed last year’s levels. These conditions indicate that the market will continue to be tight through the fall and winter into early spring. The tight supply and strong demand will continue to put upward pressure on sale prices and it should somewhat temper the normal price declines that occur in the fall and winter.”

The Shenehon Center’s report for August includes an analysis of the low inventory of homes on the market, the shortage of vacant lots available for the construction of new homes, and the expected demand for new housing based on job growth in the Twin Cities.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley at hwtousley1@stthomas.edu.