Strong housing-market benchmarks – including home prices and the number of sales – have continued well into the fall season across the 13-county Twin Cities region, according to a monthly analysis conducted by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

Strong housing-market benchmarks – including home prices and the number of sales – have continued well into the fall season across the 13-county Twin Cities region, according to a monthly analysis conducted by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

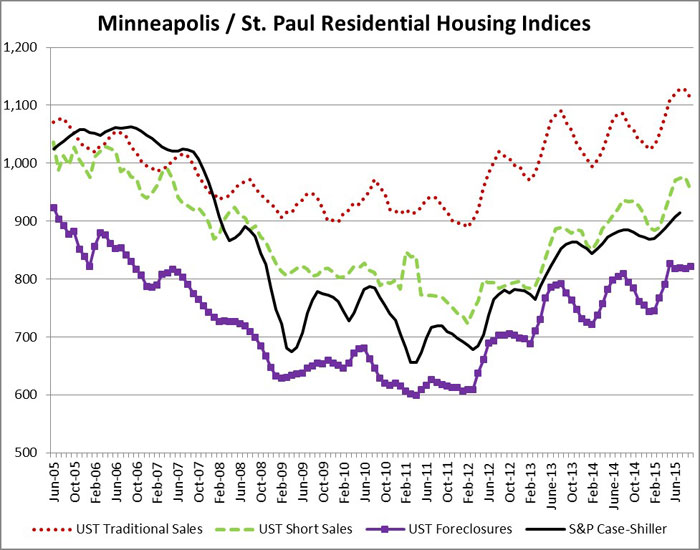

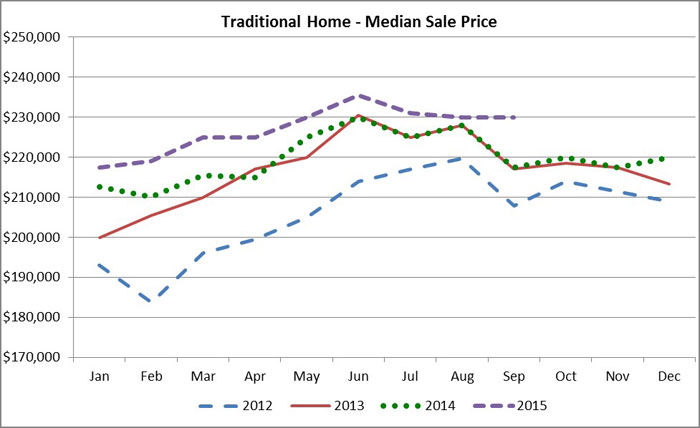

Each month the center tracks the median price for three types of sales: nondistressed or traditional; foreclosures; and short sales (when a home is sold for less than the outstanding mortgage balance). In addition, it looks for trends in the market and creates a monthly composite index score by tracking nine data elements for those three types of sales.

In September 2015 the $230,000 overall median sale price of a single-family home was unchanged from August but is 6 percent higher than in September 2014. Likewise, compared to last year the number of closed sales was up 12.5 percent and the number of pending sales (homes that are sold but have not yet closed) was up 11.9 percent.

Herb Tousley, director of real estate programs at the university, cites two factors that are keeping the sale prices up: above-average wage growth and a historically low number of homes on the market (down 15.5 percent in September compared to a year ago). “We are continuing in a sellers’ market,” he said. “Look for these trends to persist through October before the market settles down a bit during the holiday season.”

Build to rent – a new trend heading in our direction?

A lack of existing housing inventory, a relatively low number of new housing starts combined with a tight rental market is causing some builders to change their strategy; they are starting to build homes specifically for rental. This is a new trend that is beginning to appear in a number of markets across the country.

According to The Wall Street Journal, 5.85 percent of the 535,000 single-family homes started in 2013 were built to rent. That number is expected to continue to increase over the next several years. This trend is being driven by the lack of a once-plentiful supply of existing distressed homes that could be purchased a deep discount, renovated and then converted into rental properties.

“For the last several months the percentage of distressed sales in in the Twin cities has been less than 9 percent,” Tousley said. “And that means there have been few distressed homes available.”

Builders are building three- and four-bedroom homes specifically to rent to families. They can select durable materials and interior finishes that can withstand increased wear and tear. And because these homes are new, expenses such as repairs and maintenance will be much lower than comparable older, existing housing.

“Some builders are selling these homes to institutional buyers as a way to sell homes in a hurry that allows them to keep their crews busy and cash coming in the door,” Tousley said. “In some cases, these homes are being sold in bulk to institutional buyers at an 8 percent to 10 percent discount. In tight rental markets like ours, investors believe that continued rent growth and rising home values will allow them to reach their investment objectives.”

He said the build-to-rent trend is beginning to appear in several forms. Some investors are buying newly built homes from builders on lots in new subdivisions and in long-standing, established neighborhoods that are located in the same general geographical area. These large investors already own and rent homes that are scattered in different locations and they have the infrastructure in place to manage and care for the properties.

In some cases developers are building entire rental communities that have three- and four-bedroom homes built with higher quality materials that will offer amenities similar to high-end apartments such as a club house, fitness center and resort-style pool area. Landscaping and exterior maintenance will be reduced where crews can mow all of the yards, plow snow and maintain the common areas on a large-scale basis.

“These communities would be attractive to a number of potential tenants,” Tousley said. “These homes would appeal to families who are new to the area and would like to get to know the market before they buy. This gives renters a chance to live in a nice neighborhood while they look for a home to purchase. Other renters would like to live in a high-quality neighborhood but don’t have the down payment required to purchase a home at this time. Some developers are offering these homes as an opportunity for renters to save for a down payment and build their credit until they can qualify for a mortgage. A rent-to-own concept could help potential buyers purchase a home in today’s tougher lending standards.

“While we haven’t seen build-to-rent activity yet in the Twin Cities, I wouldn’t be surprised to see this trend emerge here in the near future,” Tousley said.

The St. Thomas indexes

Here are the Shenehon Center’s monthly composite index scores for September 2015. The index, which tracks nine data elements for the three types of sales (traditional, short sales and foreclosures), started in January 2005. For that month, the center gave each of the three indexes a value of 1,000.

The September 2015 index score for traditional sales was 1,114, down from the record-high 1,126 in August. The downturn is blamed, in part, on declines in the number of new listings and closed sales.

The September 2015 index score for short sales was 955, down from 975 in August. There were only 97 short sales in the 13-county Twin Cities region in September, representing 1.9 percent of total sales.

The September 2015 index score for foreclosures was 822, up from 818 in August. There were 333 foreclosure sales in September, representing 6.4 percent of total sales.

More information online

The Shenehon Center’s charts and report for September can be found on its website here.

The index is available free via email from Tousley at hwtousley1@stthomas.edu.