Double-digit gains in home prices unlikely in 2014

Look for a “maturing recovery” this year in the Twin Cities housing market, according to the Residential Real Estate Price Report Index, a monthly analysis of the 13-county metro area prepared by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

Each month the Shenehon Center tracks nine housing-market data elements, including the median price for three types of sales: nondistressed or traditional-type sales, foreclosures, and short sales (when a home is sold for less than the outstanding mortgage balance).

Herb Tousley, director of real estate programs at the university, said that as it enters its third year, the Twin Cities’ housing recovery will continue, but it will be a “maturing recovery.”

“Look for the housing market to move more into balance during the second half of the year as 2014 shapes up to be another year of solid gains and a big step toward normality in the housing market,” Tousley said.

“The previous two years have seen double-digit gains in median sale prices and a healthy increase in sales activity. The percentage of distressed sales (foreclosures and short sales) has declined from the mid-50 percent range to the low 20 percent range as the foreclosure crisis continues to recede.

“We have seen the housing market swing from being a buyer’s market two years ago to a seller’s market with the inventory of homes for sale decreasing to ever-lower levels.

“In the maturing recovery of 2014, median prices will continue to increase but at a lower rate. Traditional (nondistressed) prices should increase 4 percent to 6 percent, and distressed-sale prices will increase 7 percent to 9 percent, leading to an overall increase of 5 percent to 7 percent.

“Increasing sale prices will bring more homes onto the market as more homeowners are no longer underwater and equity positions continue to improve. The balance between buyers and sellers should approach a more normal proportion during the second half of 2014.

“The percent of distressed sales should be near 10 percent by year-end as the number of foreclosures will continue to decline,” he said. Before the housing crisis, foreclosures and short sales represented 5 percent or less of homes on the market.

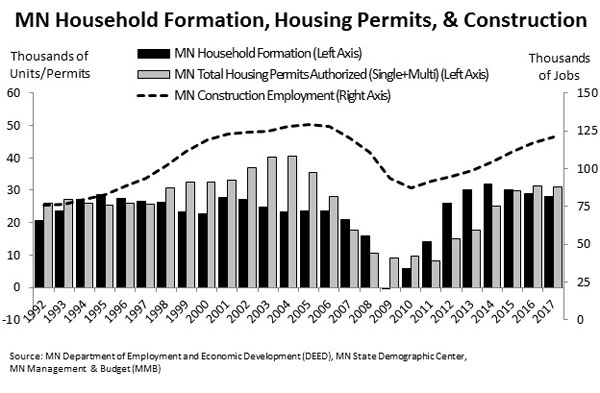

Some key measures the Shenehon Center considers in making housing projections are the number of new jobs and new households in the state and metro area. With Minnesota employment at pre-recession levels, it is expected that 30,000 to 40,000 new jobs will be created in the metro area this year. Along with that will be the formation of 32,000 new households in the state; most of those will be in the Twin Cities.

Those increases, coupled with the low number of homes on the market right now, will create in the short run an unmet demand for housing. That will put upward pressure on sales prices, which is good news for home builders and sellers.

Mortgage interest rates are expected to increase modestly this year but they will still be historically very low and should not have a major impact on housing.

According to the Keystone Report, the 5,110 permits issued for new single-family homes in the metro area last year was a 25.9 percent increase over 2012. Although there continues to be a shortage of finished lots and skilled labor in some areas of construction, Tousley said the chronic shortage of homes on the market and a generally improving economy should lead to another 25 percent to 30 percent increase in the number of single-family permits in 2014.

Specifically for the month of December 2013, the Shenehon Center found that market indicators took an expected seasonal downturn from November 2013, but that indicators for December 2013 were running ahead of December 2012.

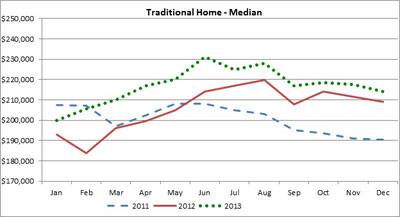

The median price of a traditional (nondistressed) metro area home in December 2013 was $214,000, down 1.6 percent from the previous month but up 2.4 percent from the same month the year before.

The median price of a traditional (nondistressed) metro area home in December 2013 was $214,000, down 1.6 percent from the previous month but up 2.4 percent from the same month the year before.

Of note, the inventory of metro-area homes for sale hit 11,797, the lowest level seen in 10 years.

The St. Thomas Indexes

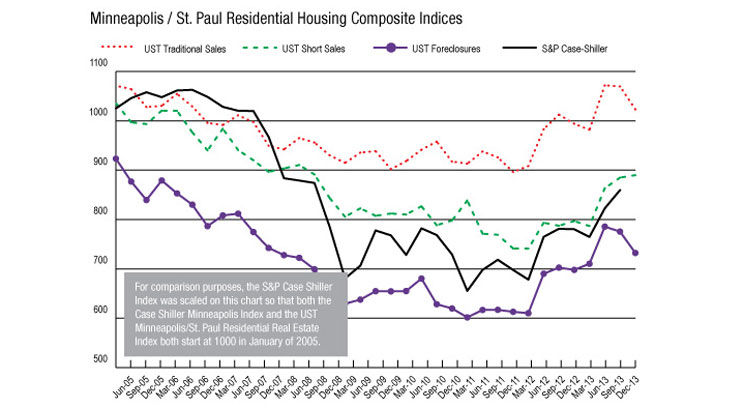

The St. Thomas Traditional Sale Composite Index, the one that tracks nine data elements, stands at 1,023 for December 2013. It took a 12-point seasonal downturn from November 2013 but is 3.1 percent above December 2012.

Likewise, the December index for short sales is 12.7 percent higher than a year ago, and for foreclosures the index is 5.2 percent higher.

More information online

The Shenehon Center’s report for December can be found here; it includes charts showing the median sale price of homes, household formation and building permits, and indexes for the traditional, foreclosure and short-sale markets.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley at hwtousley1@stthomas.edu.