Unease about the economy is putting a damper on the holiday spending plans of Twin Cities area shoppers, according to the University of St. Thomas' latest "Holiday Spending Sentiment Survey" that was released Wednesday.

The eighth annual survey, conducted in late October and early November, is designed to measure what Twin Cities shoppers think they will spend for holiday gifts, what they will spend it on, and where they will spend it. The research is conducted by Dr. Lorman Lundsten, Dr. Dave Brennan and Dr. John Sailors at St. Thomas’ Opus College of Business.

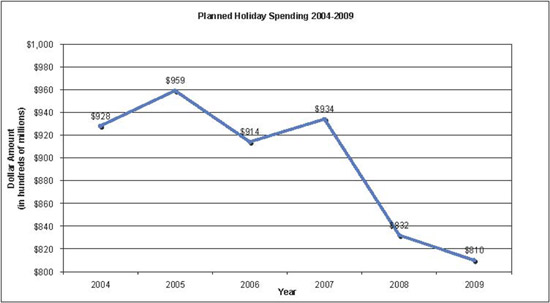

According to the survey, aggregate household spending for holiday gifts is predicted to be 2.7 percent less in the Twin Cities this year than in 2008. While not a large decline, it comes on the heels of a significant 10.9 percent decrease that was predicted the previous holiday shopping season.

This year's predicted household spending for holiday gifts, $637, is the lowest since St. Thomas began the study in 2002. There was no rebound from a year ago, when the predicted household spending of $663 was a significant decline from the $751 predicted for 2007. The highest predicted outlay, $796, was in 2004.

More than half of the shoppers surveyed this year, 53.8 percent, said they planned to spend less than last year. That group was evenly divided between "spend a little less" and "spend much less." When asked why, the most frequent responses were "income is less" and "financial crunch." Only 7.6 percent planned to spend more.

Sixty percent of the respondents said their households would spend less than $500 this year, while 27.7 percent said they would spend between $501 and $1,000.

A season of uncertainty

The three professors who conducted the study note that actual spending might be different because shoppers could spend more or less than they planned once they get into the stores. They agree, however, that "malaise" describes the Twin Cities holiday shopping mood this season.

"We have a gloomy group of shoppers out there this year," Brennan said. "The sizable decline in predicted spending we saw one year ago was the largest we have found and was understandable in light of 2008's stock-market tumble, gasoline prices, housing-market meltdown and the sub-prime financial-liquidity crisis.

"This year the market has come back to some degree, but now the unemployment numbers are the highest since 1983. I think there is a sense of uncertainty. Shoppers are planning to spend less because they don't have as much, or because they are uncertain about the future. We are seeing the mood of consumers one year into the recession. This is what the holiday shopping season looks like in a jobless recovery."

The professors, meanwhile, feel that retailers are better prepared this time around for spending that is flat or down.

"The stores' inventories are in better shape this year, and the kinds of products they are stocking are not as risky. They are stocking more traditional items to make sure they sell," Lundsten said.

"Holiday shoppers in recent years have come to expect big sales. But with inventory at better levels, we won't see the dramatic kinds of sales we saw last year," Lundsten added. "There will be selective sales, but they won't be as deep and across the board. They won't be as spectacular as last year."

The St. Thomas study paints a more pessimistic shopping picture than national surveys, but not by much. While St. Thomas predicts a 2.7 percent decline this season, Deloitte & Touche predicts no change nationally from last year, the National Retail Federation predicts a 1 percent decline, and the International Council of Shopping Centers predicts a 1.8 percent increase at shopping centers and a 1 percent increase at chain stores.

"In the first three years of our survey, the Twin Cities findings mirrored national predictions," Brennan noted. "For the last five years, however, respondents to our Twin Cities survey said they planned to spend less, on a percentage basis, than the numbers reported in the national surveys."

Based on the local responses and the population of the greater Minneapolis-St. Paul metro area, the researchers predict that the metro-region shoppers will cumulatively spend $810 million this year, down from last year's predicted $832 million. This is also the lowest amount since the survey began in 2002. The highest was a predicted $959 million in 2004.

A peek under the tree

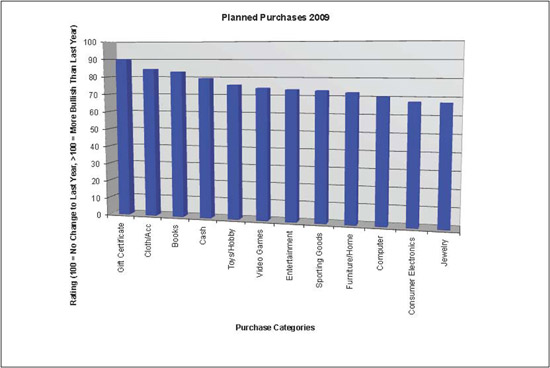

What will Twin Cities-area shoppers buy with their $663? The professors created an index to analyze the relative popularity of a dozen gift categories. It sheds light on the “what’s hot” question and allows year-to-year comparisons.

The categories -- listed by most-popular first -- are: gift certificates, clothing and accessories, books, cash, toys and hobbies, video games and related gear, entertainment, sporting goods, furniture, computers and related gear, consumer electronics and jewelry.

That's close to last year's list, but there have been some changes. Gift certificates moved from second last year to first this year. Clothing also jumped one spot, to second. Books slid from first in 2008 to third this year. The other categories changed only slightly, except for video games; it moved up from 10th to sixth.

The researchers observed a theme that emerged in an open-ended question on this year's survey. When asked if there were any other products that respondents might give this year, but were not listed on the survey, many wrote in "food" or "groceries."

"These would include home-baked and purchased food items," Brennan said. "When the survey elsewhere asked about gift certificates, it did not specify what kind of gift certificates. We don't know for sure, but likely some of those gift certificates would be for food."

Where they spend

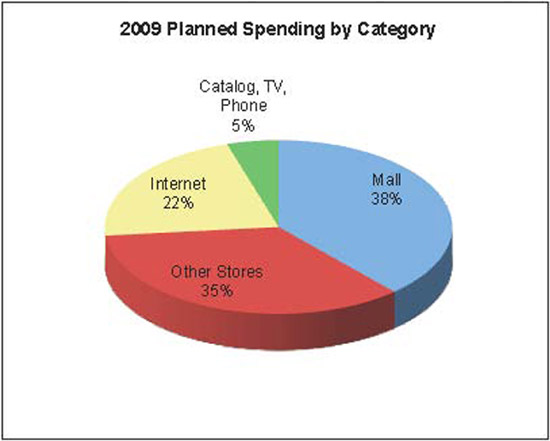

For the past eight years the survey has asked shoppers where they plan to spend their money. This year's results continue to reinforce a gradual trend toward the Internet and away from catalogs.

This year, shoppers said they plan to spend 21.8 percent of their holiday budget using the Internet. That's up from 9.5 percent four years ago and up from 18.6 percent one year ago. That compares to 4.8 percent this year using catalogs, which is down from 6.8 percent four years ago and 5.8 percent last year.

Shoppers also said this year that they plan to spend 38.4 percent of their budget at the nine regional shopping malls or downtowns. That's close to last year, but down from 50.1 percent four years ago. Shoppers will spend another 35 percent of their budget at non-mall stores this year, a percentage that hasn't seen much change since the survey began in 2002.

Most-popular malls and stores

Which of the regional malls are going to get the largest share of that $637 holiday budget?

When asked which malls they planned to visit for their holiday shopping, this year's respondents listed, from most-popular to least-popular: Mall of America, Rosedale, Ridgedale, downtown Minneapolis, Southdale and Burnsville (tie for fifth), Northtown, Maplewood, Eden Prairie, downtown St. Paul and Brookdale.

By comparing the malls of choice and where the respondents live, the survey results show that shoppers favor malls closest to home.

When asked which stores they planned to visit for holiday shopping, the top five were Target, Walmart, Kohl's, J.C. Penney and Macy's. Target was the overwhelming favorite choice and was mentioned nearly twice as often as Walmart.

When asked which Web sites they planned to visit for holiday shopping, the top five were Amazon, eBay, Overstock, Target and Kohl's. In this case, Amazon was the clear favorite and was mentioned three times as often as eBay.

What the findings tell us

Based on this year’s survey, as well as other financial data, the St. Thomas retail researchers conclude that:

- Malaise, unease and uncertainty are words that describe the mood of shoppers this holiday season. The 2009 survey respondents are financially strapped or worried about the future.

- Caught in 2008 with too many goods and not enough shoppers, retailers lowered their holiday inventory this year.

- There still will be sales and promotions, but don't look for the dramatic price cuts seen a year ago.

- Results from St. Thomas' eight annual surveys show that 2004 was a highpoint for Twin Cities shoppers and retailers. There's been a gradual downward trend since (except for one year ago when the downward trend was steep, not gradual).

- The Internet is not changing the way we shop overnight. But while its growth has been slow, it has been steady.

- Maybe it is a sign of the times, but many are planning to give presents of food this year.

- The Mall of America wins this year's most-popular-holiday-shopping-destination contest. One out of five Twin Cities shoppers plan to visit there. Rosedale, which held that title from 2004 to 2006, is solidly in second.

- Target was the holiday shoppers' hometown favorite. It was the survey respondents' top choice among traditional "brick and mortar" stores. Although dwarfed by Amazon, Target tied for third as the most popular Internet shopping site.

- The St. Thomas researchers can only wonder what the results of this survey would look like if taken in an urban area that has been hit, for example, by massive layoffs in the automotive industry. Things here could be worse.

The researchers

Lundsten and Brennan are both longtime members of the Opus College of Business faculty. Sailors joined the faculty in 2005.

Lundsten is a professor of marketing and chairs the university’s Marketing Department. He holds a doctorate from the University of Michigan.

Brennan, who holds his Ph.D. from Kent State University, is a professor of marketing and co-director of the university’s Institute for Retailing Excellence.

Sailors is a specialist in consumer behavior, marketing research, and brand equity and loyalty; his doctorate is from Northwestern University.

The Institute for Retailing Excellence, part of the St. Thomas Opus College of Business, conducts research and offers educational programs for those who work in retailing.

Survey method

This year’s holiday spending survey included 303 responses from households in the 13-county Minneapolis-St. Paul Metropolitan Statistical Area, which includes two counties in western Wisconsin.

The respondents reflect the demographics of the area as well as those who responded to previous holiday spending surveys. Respondents this year were more likely to be female (66.9 percent) and married (60.4 percent). As might be expected, there was an increase this year in the number of respondents from lower-income households and a decrease in the number from upper-income households.