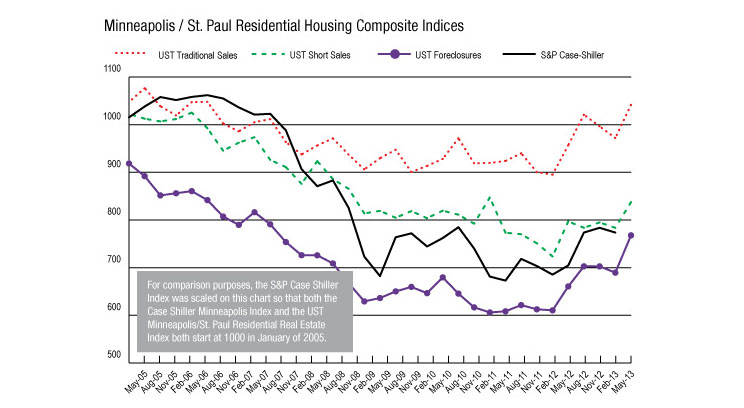

Median home sale prices in May continued to show significant gains compared to the same period last year, according to the Residential Real Estate Price Report index, a monthly analysis of the 13-county metro area prepared by the Shenehon Center for Real Estate at the St. Thomas Opus College of Business.

In the Twin Cities, the median sale price of a traditional home (not a foreclosure or short sale) in May was $220,000, an increase of 1.4 percent over the $217,000 reported in April and a 7.3 percent increase over the May 2012 median price of $205,000.

Overall, the median sale price for all homes sold in the Twin Cities has been recording double digit year-over-year gains for the past 13 months. Many of the other market indicators are positive as well. When compared to last year, new listings are up 26 percent and pending sales are up 17.9 percent.

The continuing uptick in sale price is a good sign that the market is recovering, according to Herb Tousley, director of real estate programs at the university. But should homeowners be concerned that another bubble is looming?

Tousley cites two reasons that there should be little concern that there will be another significant drop in home values like what happened in 2006.

“First, there are very few homes on the market for this time of year – about 13,000 versus up to 20,000 we see traditionally,” he said. “But rising prices will bring more homes for sale into the market creating a better balance between supply and demand.” He added that low interest rates are putting sellers in a position of receiving multiple offers, which is driving up prices.

In addition, Tousley notes that despite recent increases the median sale price of homes has remained in check when compared to the median household income since the end of 2008. Even though prices have been increasing in the first quarter of 2013 the ratio was 92.6 percent of the long-term average. In contrast at the height of the bubble in the fourth quarter of 2005, the ratio peaked at 140 percent of the long-term average. “As long as the ratio does not move to significantly over 100 percent, home values will not get out of proportion with household incomes and will remain affordable,” Tousley said.

In addition, Tousley notes that despite recent increases the median sale price of homes has remained in check when compared to the median household income since the end of 2008. Even though prices have been increasing in the first quarter of 2013 the ratio was 92.6 percent of the long-term average. In contrast at the height of the bubble in the fourth quarter of 2005, the ratio peaked at 140 percent of the long-term average. “As long as the ratio does not move to significantly over 100 percent, home values will not get out of proportion with household incomes and will remain affordable,” Tousley said.

Another positive sign from the May report is the proportion of distressed sales taking place each month continued its decline that began in January of this year. The percentage of closed sales that were distressed in May 2013 fell to 26.9 percent. This is the lowest percentage of distressed sales seen since the third quarter of 2008. The number of traditional (nondistressed sales) was up 32.8 percent compared to the same period last year, and the number of short sales and foreclosed sales were down 26.5 and 20.8 percent respectively. “As we noted last month, the number of new foreclosures continues to wind down,” Tousley said. “As the existing foreclosures are sold and clear the market, expect to see a continued reduction in the percentage of distressed sales throughout the late spring and summer.”

More details can be found on the Shenehon Center’s website.

More details can be found on the Shenehon Center’s website.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley.